After dedicating decades to shaping young minds, Missouri educators deserve retirement security that reflects their service and sacrifice. Unlike private sector workers who navigate 401(k) accounts and individual retirement planning alone, Missouri’s public school educators benefit from established pension systems designed to provide predictable retirement income based on service years and salary history.

However, these systems operate under complex rules governing vesting periods, benefit calculations, early retirement provisions, and cost-of-living adjustments. Educators who understand these details make better decisions about retirement timing, supplemental savings needs, and long-term financial planning. Whether you’re a first-year teacher decades from retirement or an experienced educator approaching eligibility, understanding Missouri’s teacher retirement systems empowers better planning throughout your career.

Understanding Missouri’s Two Retirement Systems

Missouri operates separate retirement systems for different categories of public school employees, each with distinct rules, contribution requirements, and benefit structures.

PSRS: Public School Retirement System for Certified Teachers

The Public School Retirement System (PSRS) covers certificated teachers and administrators employed by Missouri public schools and certain education-related agencies. This includes classroom teachers across all grades and subjects, building principals and assistant principals, superintendents and central office administrators, school counselors, librarians, and other certified staff, and certain education service agency employees.

PSRS represents one of the best-funded public pension systems nationally, with consistent actuarial health supporting its long-term sustainability. The system serves approximately 75,000 active contributing members and pays benefits to roughly 55,000 retirees and beneficiaries.

Contribution Structure: Both employees and employers contribute to PSRS funding. For the 2025-2026 school year, employees contribute 14.5% of their gross salary through automatic payroll deduction. Employers contribute an equivalent 14.5% on behalf of each employee. These combined contributions—totaling 29% of salary—fund the system’s defined benefit promises.

Unlike 401(k) plans where employees direct investments and bear market risk, PSRS contributions flow into professionally managed pools that assume all investment risk. Members receive promised benefits regardless of investment performance—the system, not individual employees, bears financial market risk.

Vesting Requirements: Missouri teachers become vested in PSRS benefits after completing five years of credited service. Vesting means educators have earned the right to receive retirement benefits based on their service, even if they leave public education before reaching retirement eligibility age.

Non-vested members who leave before five years can withdraw their employee contributions plus accumulated interest but forfeit employer contributions and all pension benefits. This makes the five-year mark critical for teachers considering career changes.

PEERS: Public Education Employee Retirement System

PEERS covers non-certificated school employees including custodial and maintenance workers, food service employees, clerical and secretarial staff, paraprofessionals and classroom aides, bus drivers and transportation employees, technology support staff, and other support personnel not requiring teaching certificates.

PEERS operates similarly to PSRS but with different contribution rates and benefit formulas reflecting the distinct employment patterns typical in support positions.

Contribution Structure: PEERS members contribute 6.86% of gross salary through payroll deduction. Employers contribute an additional 6.86% on members’ behalf. These combined contributions—totaling 13.72%—fund PEERS benefits at lower rates than PSRS, reflecting the system’s different benefit structure.

Vesting Requirements: Like PSRS, PEERS members vest after five years of credited service, earning the right to future retirement benefits even if leaving public school employment before retirement eligibility age.

Eligibility Requirements and Retirement Options

Understanding when you become eligible for retirement benefits and what options exist at different ages helps educators plan retirement timing strategically.

PSRS Full Retirement Eligibility

PSRS members can retire with unreduced benefits under several scenarios meeting what the system calls the “Rule of 80”:

Age and Service Combinations: You qualify for full retirement benefits when your age plus years of service equal at least 80, AND you meet one of these minimum requirements: age 60 with at least 5 years of service, age 55 with at least 10 years of service, or any age with at least 31 years of service.

For example, a teacher who began at age 23 and worked continuously could retire at age 54 with 31 years of service (54 + 31 = 85, exceeding the Rule of 80). Alternatively, a career-change teacher starting at age 40 would need to work until age 60 with at least 20 years to reach the 80 combination (60 + 20 = 80).

Normal Retirement Age: Members automatically qualify for full benefits at age 60 with at least 5 years of service, regardless of whether they meet the Rule of 80.

PSRS Early Retirement Options

Educators who don’t meet full retirement eligibility can retire early with reduced benefits under specific conditions.

Age 55 Early Retirement: Members can retire as early as age 55 with at least 5 years of service, but benefits are permanently reduced based on how many months before full eligibility they retire. The reduction equals 6% per year (0.5% per month) for each year before meeting normal retirement eligibility.

For example, a 55-year-old with 10 years of service hasn’t met the Rule of 80 (55 + 10 = 65). If this member’s Rule of 80 date would occur at age 60, retiring five years early means a 30% permanent benefit reduction (6% × 5 years).

This substantial reduction makes age 55 retirement financially challenging for most educators unless they have significant supplemental retirement savings or other income sources.

PEERS Retirement Eligibility

PEERS members qualify for full retirement benefits under similar but slightly different rules:

Full Retirement: PEERS members can retire with unreduced benefits at age 60 with at least 5 years of service, age 55 with at least 25 years of service, or under the “Rule of 80” (age plus service equals 80 or more).

Early Retirement: PEERS allows early retirement as young as age 55 with 5 years of service, with permanent benefit reductions similar to PSRS early retirement penalties.

Calculating Your Retirement Benefits

Understanding how Missouri calculates pension benefits helps educators estimate retirement income and plan accordingly.

PSRS Benefit Calculation Formula

PSRS uses a defined benefit formula multiplying three key factors:

Formula Components:

- Final Average Salary (FAS): Your highest consecutive 3 years of salary averaged together

- Years of Credited Service: Total years and fractional years of covered employment

- Multiplier: 2.5% per year for the first 30 years, 2.55% per year for years 31+

Calculation Example: Consider a teacher retiring with 30 years of service and a final average salary of $65,000:

Annual Benefit = $65,000 × 30 years × 2.5% = $48,750 per year

Monthly Benefit = $48,750 ÷ 12 = $4,062.50 per month

This represents approximately 75% income replacement (48,750 ÷ 65,000), well above the 60-70% replacement ratio many financial planners recommend for comfortable retirement.

Enhanced Multiplier After 30 Years: The slight increase to 2.55% after 30 years rewards long-service educators. A teacher with 35 years of service and $70,000 FAS would calculate benefits as:

(30 years × 2.5%) + (5 years × 2.55%) = 75% + 12.75% = 87.75% multiplier

Annual Benefit = $70,000 × 87.75% = $61,425

This generous formula means career educators who work 30+ years often receive retirement income approaching their working salary.

PEERS Benefit Calculation Formula

PEERS uses a different formula reflecting the system’s distinct member population:

Formula: 1.61% multiplier × Years of Service × Final Average Salary (highest 3 consecutive years)

Calculation Example: A PEERS member retiring with 25 years of service and $35,000 FAS:

Annual Benefit = $35,000 × 25 years × 1.61% = $14,087.50 per year

Monthly Benefit = $14,087.50 ÷ 12 = $1,173.96 per month

The lower multiplier reflects PEERS’ lower contribution rates and different benefit design philosophy, though it still provides meaningful retirement income supporting members’ financial security.

Factors Affecting Your Final Average Salary

Since retirement benefits depend heavily on final average salary, understanding what counts toward this calculation matters significantly:

Included Compensation: Regular salary payments, administrative stipends and extra duty pay (coaching, department chair, etc.), and longevity or step increases.

Excluded Compensation: Generally excluded are severance payments, accumulated sick or vacation leave payouts (though this varies), retirement incentive payments above certain thresholds, and certain one-time bonuses or irregular payments.

Some districts offer “salary bumps” or additional responsibilities during educators’ final years to boost retirement benefits. While this practice continues in some locations, it has faced increased scrutiny and regulatory limitations designed to prevent pension spiking.

Cost-of-Living Adjustments and Benefit Protection

Understanding how Missouri protects retiree purchasing power through cost-of-living adjustments helps educators plan for inflation’s long-term impact.

PSRS Cost-of-Living Adjustments (COLAs)

PSRS provides annual cost-of-living adjustments protecting retirees against inflation, though these adjustments don’t fully track inflation rates:

COLA Formula: Each year, PSRS retirees receive the lesser of 80% of the Consumer Price Index increase or 5%. If inflation runs at 3%, retirees receive a 2.4% increase (80% of 3%). If inflation hits 8%, retirees receive the 5% maximum.

Compounding Effect: These adjustments compound annually, meaning each year’s increase applies to the previous year’s adjusted benefit rather than reverting to the original benefit amount.

Qualification Timeline: New retirees don’t receive COLAs immediately. The first COLA applies in the January following at least one year of retirement. Teachers retiring in June 2025 wouldn’t see their first COLA until January 2027.

While the 80% formula means purchasing power gradually erodes during high-inflation periods, PSRS COLAs provide significantly better inflation protection than pension systems offering no adjustments or one-time adjustments that don’t compound.

PEERS Cost-of-Living Adjustments

PEERS uses a similar but slightly different COLA structure. PEERS retirees receive annual adjustments equal to 80% of CPI increases, capped at 4% maximum annual adjustment. The lower cap reflects PEERS’ different funding structure and benefit design.

Like PSRS, PEERS COLAs compound annually and don’t begin until January following at least one year of retirement.

Survivor Benefits and Beneficiary Options

Missouri’s retirement systems offer several options for providing continuing benefits to surviving spouses or beneficiaries after members’ deaths.

Standard Survivor Benefit Options

At retirement, PSRS and PEERS members choose how to structure survivor benefits:

Single Life Annuity: This option provides the highest monthly benefit but ceases entirely upon the member’s death, leaving nothing for survivors. Single members without dependents often select this option maximizing retirement income during their lifetime.

Joint and Survivor Annuity: This reduced benefit continues paying a percentage (typically 50%, 75%, or 100%) to a designated beneficiary after the member’s death. The initial benefit is permanently reduced to fund this continuing payment guarantee.

For example, a teacher whose single-life benefit would be $4,000 monthly might receive $3,600 under a 100% joint-survivor option, but this ensures their spouse continues receiving $3,600 monthly after the teacher’s death.

Partial Lump Sum Option: Some members choose a partial lump sum at retirement combined with a reduced monthly pension. This strategy can address specific financial needs like paying off mortgages while maintaining monthly income.

Pre-Retirement Death Benefits

If PSRS or PEERS members die before retiring, benefits vary based on vesting status:

Non-vested Members: Beneficiaries receive the member’s accumulated contributions plus interest, but no ongoing pension benefits.

Vested Members: Surviving spouses of vested members can choose between a lump sum equal to contributions plus interest, or reduced monthly survivor benefits based on what the member would have received at retirement eligibility age. Children under 18 (or 22 if full-time students) may receive benefits until reaching age limits.

Supplementing Your Retirement Income

While Missouri’s pension systems provide solid foundations for retirement security, many educators supplement PSRS or PEERS benefits to enhance retirement comfort.

Understanding Income Replacement Needs

Financial planners typically recommend replacing 70-80% of pre-retirement income to maintain similar living standards during retirement. PSRS’s generous formula means career educators often approach or exceed this target through pension benefits alone, especially those working 30+ years.

However, teachers with shorter service periods, those retiring early with benefit reductions, or PEERS members with lower multipliers may need additional income sources reaching comfortable replacement ratios.

Tax-Advantaged Supplemental Savings Options

Missouri educators can access several supplemental retirement savings vehicles:

403(b) Plans: These tax-deferred retirement accounts operate similarly to private-sector 401(k) plans but serve nonprofit and government employees. Many Missouri school districts offer 403(b) plans through payroll deduction, sometimes with modest employer matching contributions.

Contributions reduce current taxable income while funds grow tax-deferred until withdrawal during retirement. For 2026, employees can contribute up to $23,000 annually ($30,500 for those 50+), though few educators can afford these maximum contributions while managing daily expenses.

457(b) Plans: Some Missouri districts offer 457(b) deferred compensation plans providing additional tax-advantaged savings opportunities. These plans allow separate contributions beyond 403(b) limits, benefiting high-earning administrators or dual-income households with capacity for significant retirement savings.

Roth Options: Many 403(b) and 457(b) plans now offer Roth versions where contributions use after-tax dollars but qualified distributions become completely tax-free during retirement. Younger educators in lower tax brackets often benefit from Roth contributions, paying taxes now at lower rates rather than later when retirement income may push them into higher brackets.

Strategic Contribution Approaches

Educators serious about supplemental retirement savings should consider:

Start Early: Compound growth makes early contributions disproportionately valuable. A teacher contributing $200 monthly from age 25 to 65 at 7% average returns accumulates approximately $525,000, while waiting until age 35 to start produces only $244,000—less than half despite just 10 years’ difference.

Automate Contributions: Payroll deduction makes saving automatic and effortless, removing temptation to skip contributions during tight budget months. Even modest automatic contributions—$50 or $100 monthly—accumulate meaningfully over teaching careers spanning decades.

Increase Gradually: Teachers receiving salary increases should immediately increase retirement contributions by at least half of each raise. This approach accelerates savings while maintaining lifestyle consistency since take-home pay still increases modestly.

Working After Retirement: Rules and Limitations

Missouri’s retirement systems allow limited post-retirement employment in public schools, but strict rules govern these arrangements to prevent abuse.

PSRS Critical Shortage Employment

PSRS permits retired members to return to work in Missouri public schools under the Critical Shortage program without suspending retirement benefits, but only under specific conditions:

Eligible Positions: Only positions that districts certify as critical shortages—typically special education, mathematics, science, and certain other hard-to-fill specialties—qualify for this exception.

Annual Hour Limits: Critical shortage employees can work up to 550 hours per school year (July 1 - June 30) without affecting retirement benefits. Exceeding this limit suspends benefits and requires repayment of benefits received during that school year.

Required Break: Retirees must have at least 2 months of complete separation from employment before returning under critical shortage provisions.

Regular Post-Retirement Employment

Outside the critical shortage program, post-retirement employment carries more severe restrictions:

Benefit Suspension: Retired PSRS or PEERS members who return to covered employment in any capacity have their retirement benefits completely suspended while working. Benefits resume when employment ends, but the working period doesn’t earn additional service credit toward an enhanced benefit.

No Double-Dipping: Missouri law prohibits simultaneously receiving retirement benefits and salary from positions covered by PSRS or PEERS, preventing “double-dipping” that strains system finances.

Consulting and Non-Covered Work

Retired educators can work unlimited hours in positions not covered by PSRS or PEERS without affecting retirement benefits. This includes private school employment, non-education work, educational consulting through independent contracts (if properly structured), and teaching at colleges and universities with separate retirement systems.

Many retired teachers successfully consult for test preparation companies, tutor privately, or work for educational publishers without affecting PSRS or PEERS benefits.

Strategic Retirement Planning Timing

Deciding when to retire involves financial calculations, personal considerations, and strategic timing that can significantly affect retirement income.

Optimizing Your Final Average Salary

Since retirement benefits depend heavily on final average salary, strategic planning during final working years can meaningfully increase lifetime retirement income:

Extra Duty Assignments: Pursuing coaching positions, department chair roles, curriculum coordination, or other stipend-bearing responsibilities during final years increases pensionable salary. A teacher earning $65,000 base salary who adds $5,000 in extra duties for their final three years increases FAS by $5,000, which produces an additional $3,750 annually for a 30-year retiree (5,000 × 30 × 2.5%)—$3,750 extra every year for life represents substantial value.

Advanced Degrees and Lane Changes: Completing graduate degrees or additional credits moving you up salary schedule lanes during final working years permanently increases retirement benefits. However, this strategy works only if completion occurs early enough that higher salaries apply for your full final three-year average period.

Avoiding Mid-Year Retirement: Teachers who retire mid-year may reduce their final average salary since that partial year counts as one of their highest three years but at reduced annual equivalent amounts. Retiring at school year end typically produces higher FAS calculations.

Considering Healthcare Coverage

Healthcare represents a critical retirement planning consideration often overlooked by educators focusing exclusively on pension calculations:

Medicare Eligibility: Medicare coverage begins at age 65, regardless of retirement age. Teachers retiring before 65 must secure health insurance bridging the gap between retirement and Medicare eligibility—often the most expensive retirement years for healthcare.

District Retiree Coverage: Many Missouri districts offer retiree health insurance, though coverage quality and subsidies vary dramatically between districts. Understanding your district’s specific retiree healthcare offerings should factor significantly into retirement timing decisions.

Spouse Coverage: Teachers married to spouses with employer-provided family health coverage may retire confidently before 65, knowing healthcare continues through spousal coverage. Those without this option face tougher decisions about whether to delay retirement until Medicare eligibility at 65.

Maximizing Social Security Benefits

Missouri educators’ Social Security situations vary depending on their career paths and whether they qualify for benefits through their own work history or spousal/survivor benefits.

Windfall Elimination Provision (WEP): This federal rule reduces Social Security benefits for people receiving pensions from employment not covered by Social Security—including Missouri PSRS and PEERS members. Teachers who worked in Social Security-covered employment before or after teaching may find their Social Security benefits substantially reduced due to WEP calculations.

Government Pension Offset (GPO): This separate rule reduces Social Security spousal or survivor benefits for those receiving government pensions from non-covered employment. The GPO reduces spousal/survivor benefits by two-thirds of the government pension amount, which can eliminate these benefits entirely.

Strategic Career Sequencing: Some educators carefully time career transitions—working sufficient years in Social Security-covered employment before teaching, or after retirement—to qualify for Social Security benefits less affected by WEP calculations. This complex strategy requires careful planning and professional guidance.

Tax Considerations for Missouri Teacher Retirees

Understanding how Missouri and federal governments tax retirement income helps educators plan for take-home retirement resources accurately.

Missouri State Tax Treatment

Missouri provides favorable tax treatment for retirement income:

Public Pension Exemption: Missouri completely exempts public pension income from state income tax for residents receiving benefits from PSRS, PEERS, and similar government retirement systems. Your entire PSRS or PEERS benefit is exempt from Missouri income tax, regardless of benefit amount.

Social Security Exemption: Missouri also exempts Social Security benefits from state income tax, providing tax advantages for retirees receiving both pensions and Social Security.

Other Retirement Income: Income from 403(b) withdrawals, IRA distributions, and other supplemental retirement accounts remains subject to Missouri income tax based on standard rates, though Missouri offers a pension and Social Security income exemption that may reduce taxable amounts.

This favorable tax treatment means Missouri retirees’ pension dollars stretch further than peers in states taxing retirement income—a significant advantage worth thousands of dollars annually.

Federal Tax Treatment

Federal income tax applies to Missouri teacher pension benefits:

Ordinary Income Tax: PSRS and PEERS benefits are taxed as ordinary income at federal rates, like wages during working years. Retirees should expect to pay federal income tax on their full pension benefits, with exact amounts depending on total retirement income and applicable tax brackets.

Quarterly Estimated Payments: Unlike working years when employers withhold taxes from paychecks, retirees typically must make quarterly estimated tax payments or elect voluntary withholding from pension benefits. Failing to pay sufficient tax throughout the year can result in underpayment penalties.

Tax Withholding Elections: Both PSRS and PEERS allow retirees to elect voluntary federal tax withholding from monthly benefits. Many retirees find this convenient, automatically setting aside taxes rather than manually making quarterly payments. You can adjust withholding amounts whenever circumstances change.

Honoring Retiring Teachers’ Lasting Legacies

Beyond financial planning, schools increasingly recognize that celebrating retiring educators’ contributions creates meaningful transitions while preserving institutional knowledge and inspiring current staff.

Recognition Programs for Career Educators

Thoughtful recognition programs honor retiring teachers’ decades of service while demonstrating organizational values to continuing staff:

Retirement Celebrations: Many schools host dedicated retirement events celebrating departing educators, featuring tributes from colleagues and former students, video compilations showcasing career highlights, personalized plaques or recognition pieces, and opportunities for retirees to reflect on their educational philosophies and share advice.

These celebrations provide closure for retiring educators while reinforcing for current teachers that their contributions will be recognized and remembered.

Legacy Projects: Some districts invite retiring educators to contribute to lasting legacy projects preserving their wisdom for future staff. This might include recorded interviews capturing teaching philosophies and strategies, documented curriculum resources and lesson materials developed over careers, mentorship relationships with teachers assuming their positions, or contributions to institutional history projects.

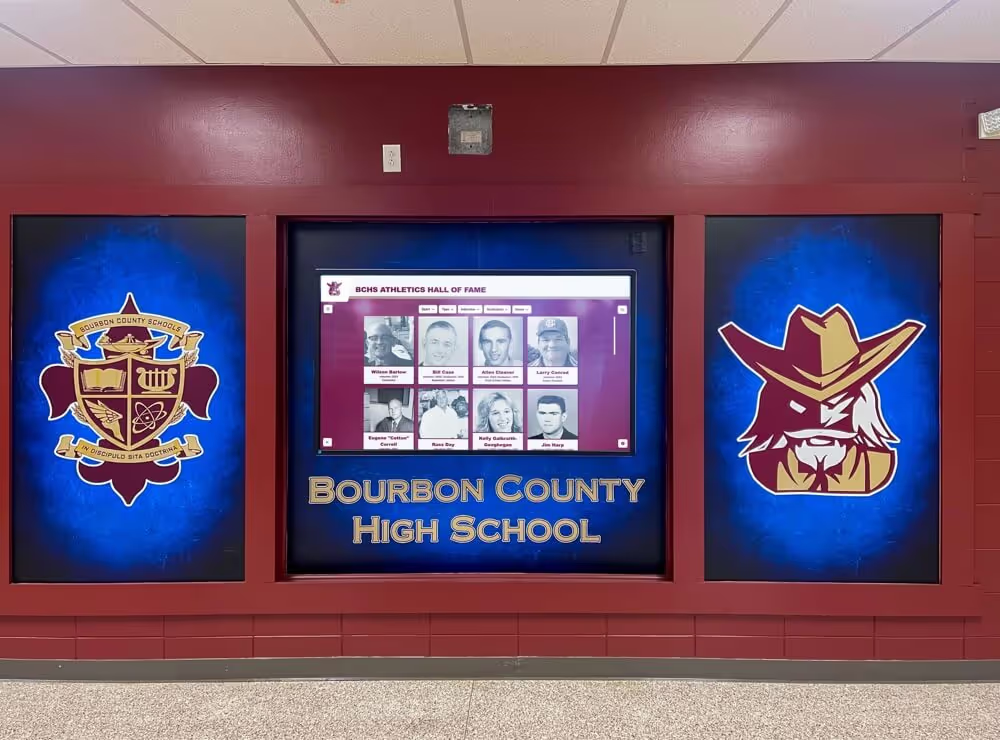

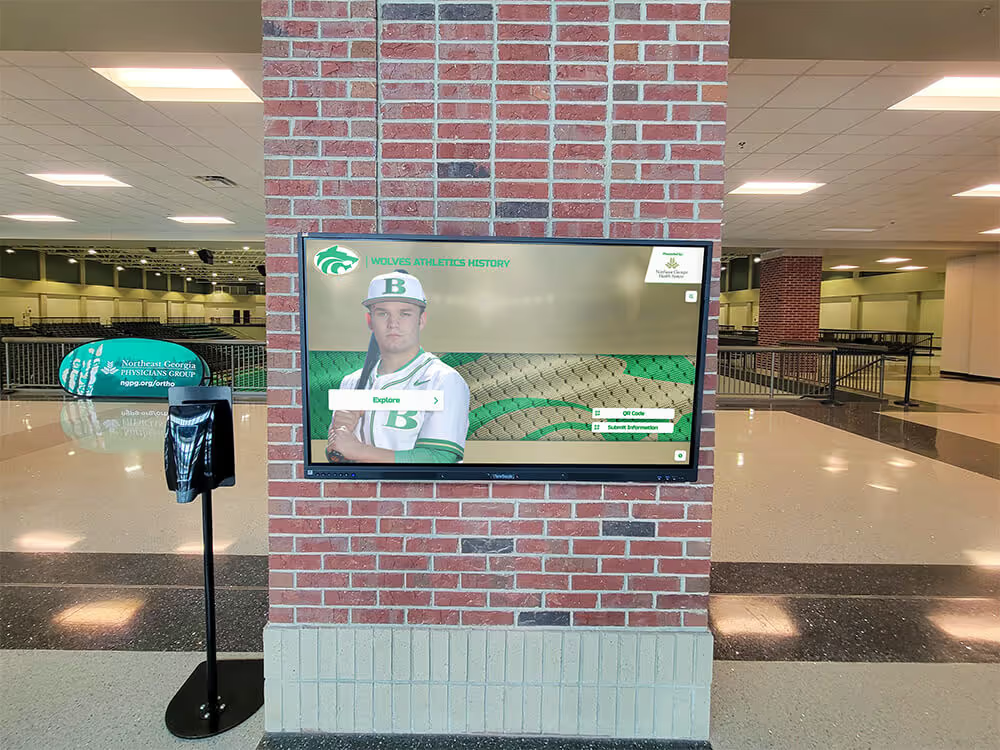

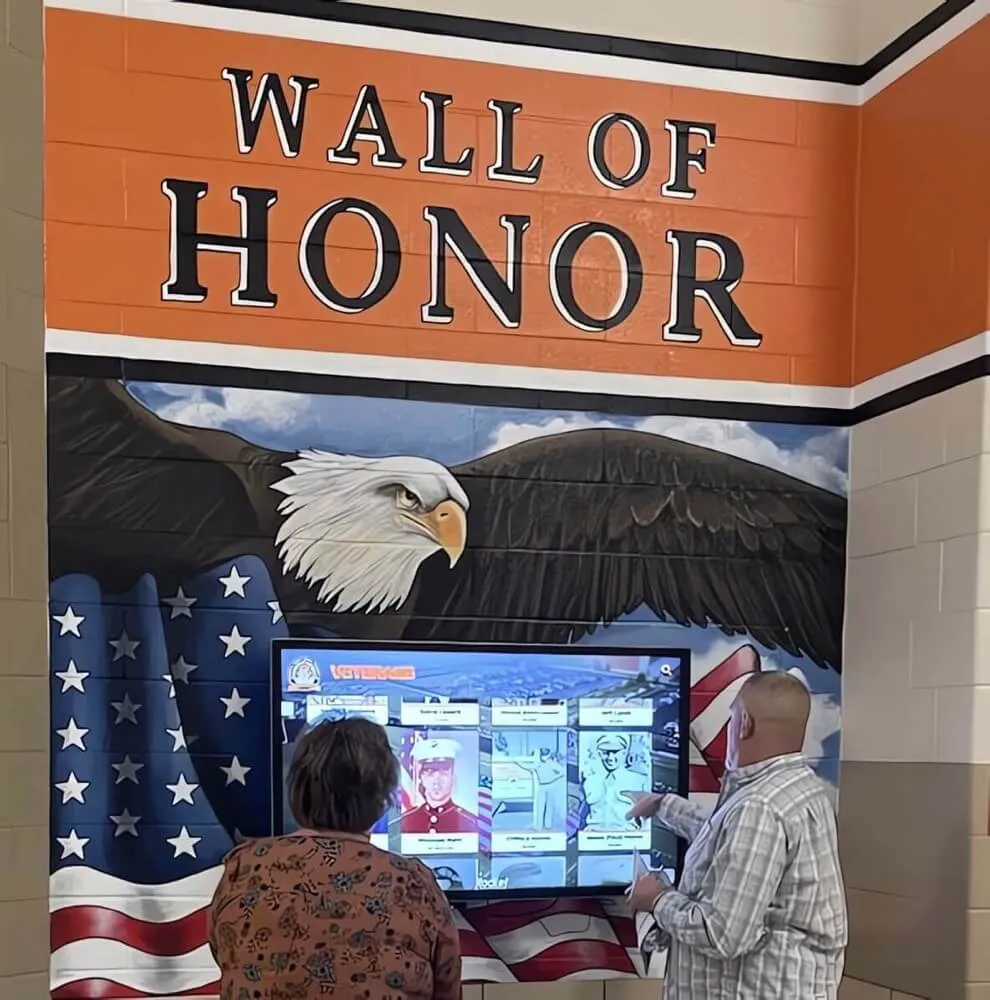

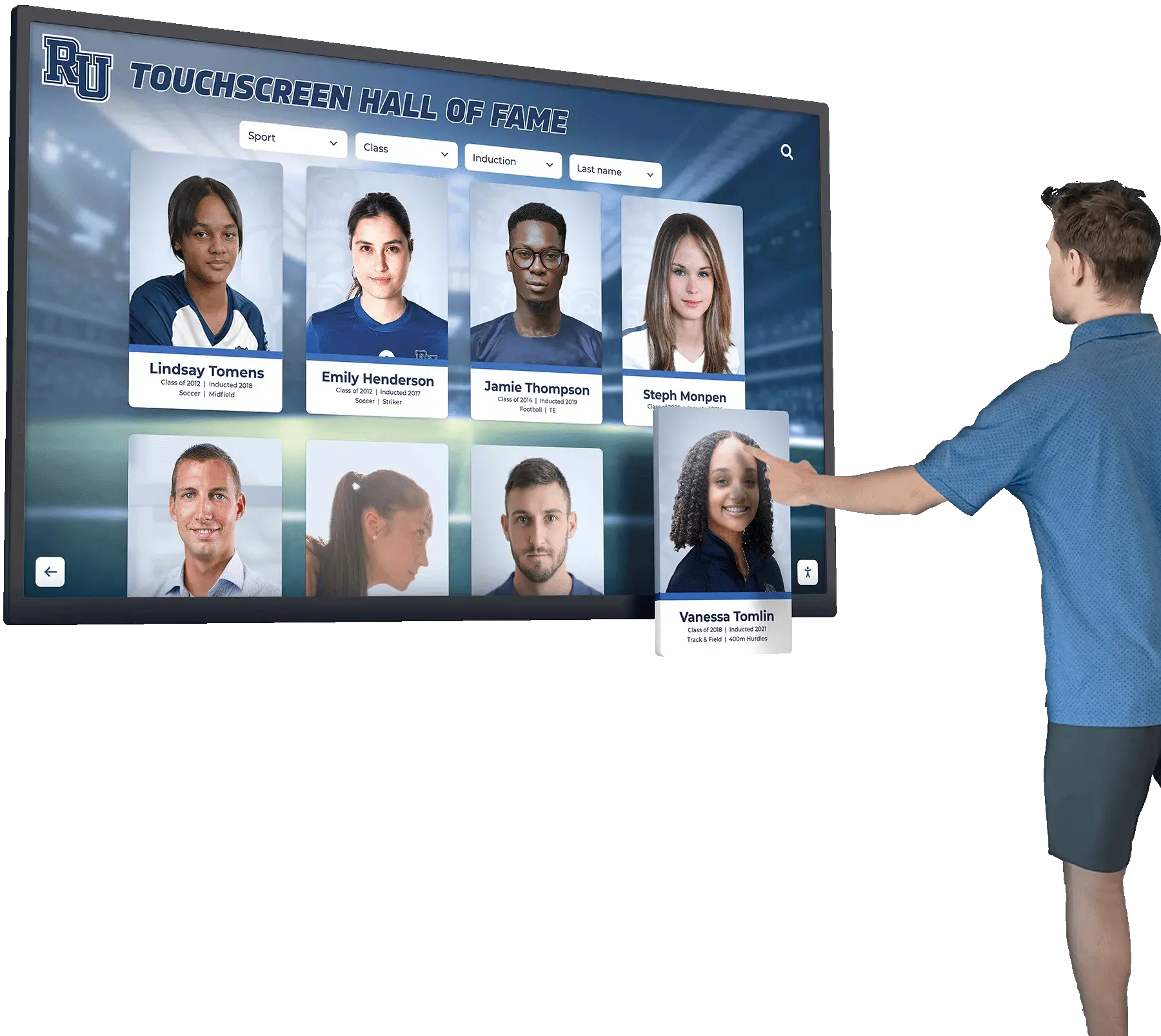

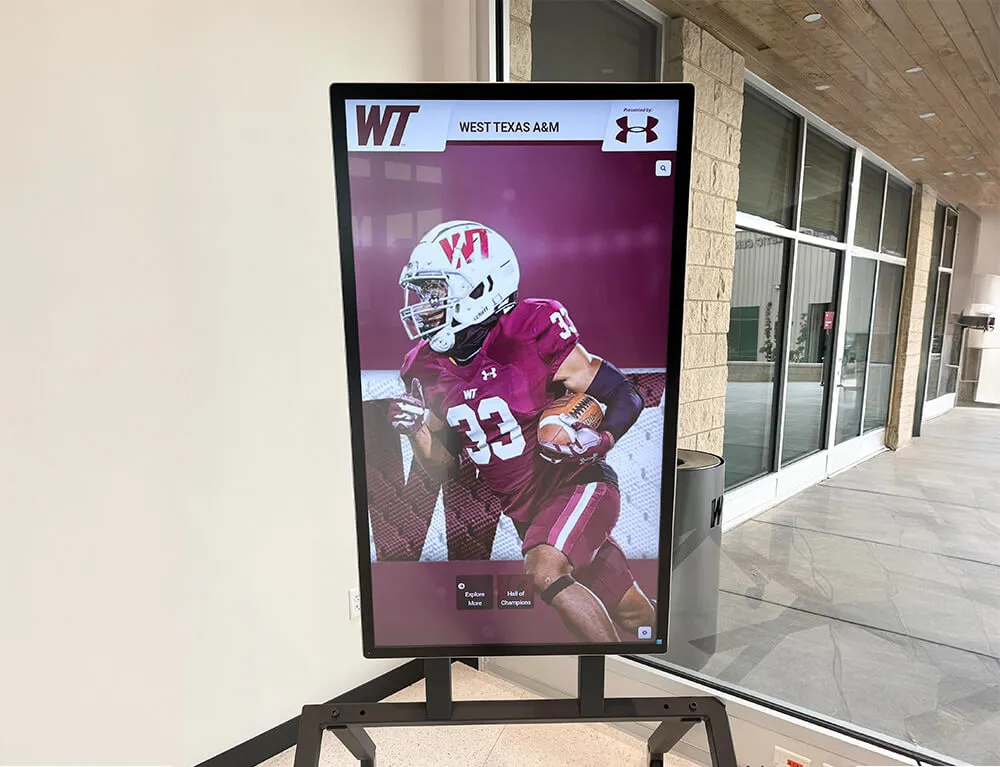

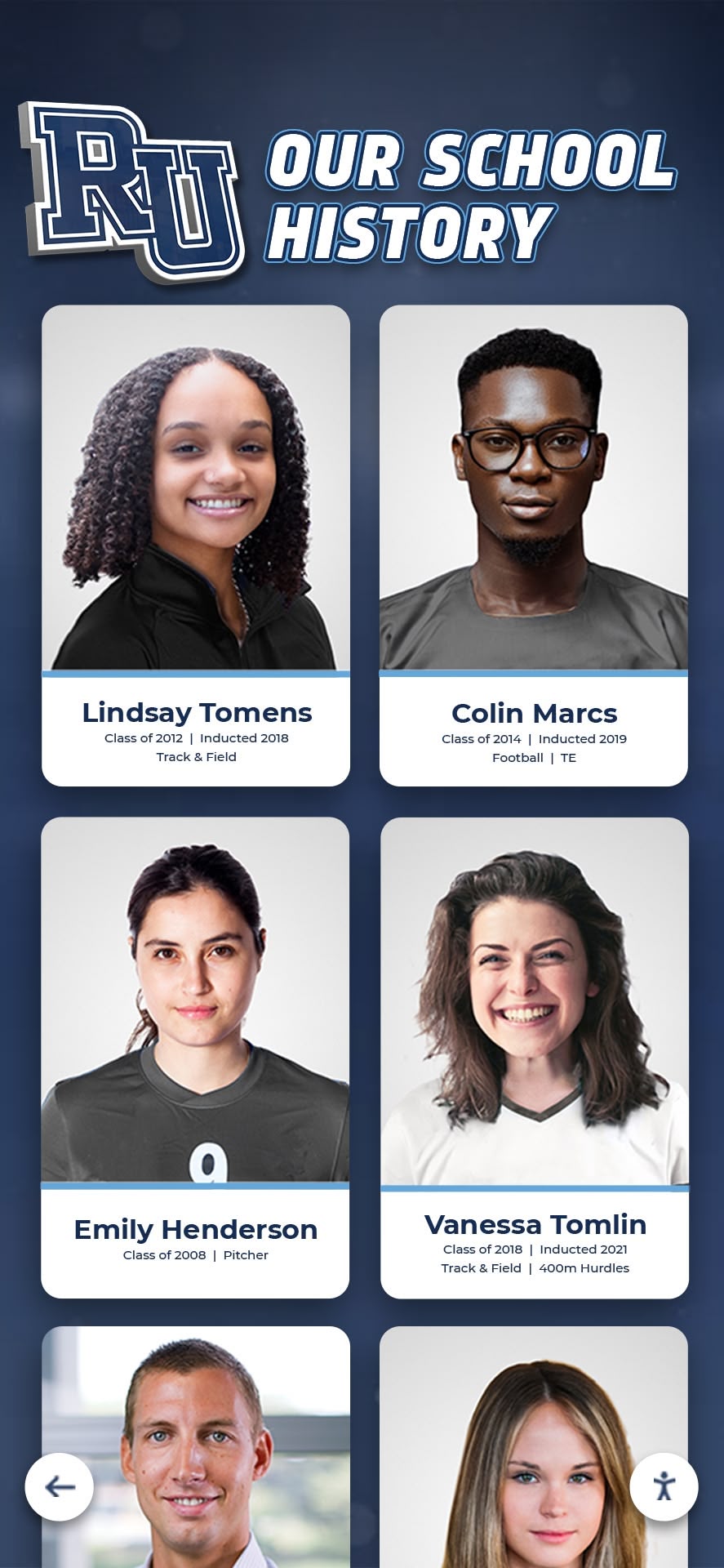

Digital Recognition Systems

Modern schools are implementing permanent digital recognition displays that honor educators’ contributions in ways traditional plaques cannot match:

Dynamic, Searchable Databases: Interactive touchscreen displays featuring comprehensive profiles of distinguished retirees, photographs spanning entire careers, searchable by name, subject area, or years of service, and video clips capturing personal messages or teaching moments.

These systems ensure retiring educators remain part of visible school culture rather than fading from memory as static plaques accumulate dust in forgotten hallways.

Community Connection: Digital recognition platforms can include sections for alumni to share memories and appreciation messages, creating ongoing connections between retired educators and the students whose lives they shaped. A mathematics teacher who retired after 35 years might periodically receive notifications that former students added grateful messages to their recognition profile—a meaningful reminder that their career mattered long after their final class ended.

Solutions like Rocket Alumni Solutions enable schools to create sophisticated recognition infrastructure that celebrates not just athletic achievements but the educators whose dedication shaped generations of students. These interactive displays transform school lobbies into spaces that visibly honor the teaching profession.

Institutional Memory Preservation: Digital systems help schools maintain institutional memory by documenting each educator’s unique contributions—specialized programs they created, innovative teaching methods they pioneered, community partnerships they built, or student groups they sponsored. This documentation ensures valuable institutional knowledge doesn’t disappear when individuals retire.

Recognition Beyond Athletics

While schools traditionally excel at recognizing athletic achievements, comprehensive recognition systems honor diverse contributions including academic excellence, arts and activities sponsorship, curriculum innovation and instructional leadership, community service and partnership building, and mentorship and professional development contributions.

Retiring teachers whose careers centered on teaching struggling readers, directing theater productions, or coaching academic teams deserve recognition equal to coaches whose teams won championships. Modern digital recognition systems enable schools to celebrate all forms of educational excellence equally.

Resources for Missouri Teacher Retirement Planning

Educators planning for retirement should utilize numerous resources providing personalized guidance and detailed information.

PSRS and PEERS Official Resources

Both retirement systems maintain comprehensive resources:

PSRS/PEERS Website: The official website (www.psrspeers.org) provides benefit calculators estimating retirement income, explanation of rules and policies, forms for various member needs, retirement planning guides and timelines, and contact information for personalized assistance.

Benefit Counseling: PSRS and PEERS offer free individual counseling sessions where retirement specialists review your personal situation, explain benefit options and survivor choices, calculate estimated benefits under different retirement scenarios, and answer specific questions about your circumstances.

These counseling sessions prove invaluable for educators approaching retirement, providing personalized guidance that generic information cannot match. Schedule counseling 1-2 years before anticipated retirement to understand options and plan strategically.

Professional Financial Planning

While PSRS and PEERS staff expertly explain system benefits, they cannot provide comprehensive financial planning addressing total retirement situations including supplemental savings, real estate, Social Security coordination, estate planning, and tax strategies.

Many educators benefit from consulting fee-only financial planners who specialize in educator retirement. These professionals understand the complexities of pension systems, Social Security offsets affecting educators, and holistic retirement planning strategies. Look for Certified Financial Planners (CFP) with specific experience serving educators rather than general financial advisors whose expertise centers on private-sector clients.

District Human Resources Departments

Your district HR department can provide information about district-specific benefits including retiree health insurance options and costs, retirement incentive programs if offered, accumulated leave payouts and calculations, and COBRA continuation coverage for those not yet Medicare-eligible.

Since district policies vary significantly, information from your specific employer proves essential for complete retirement planning.

Common Retirement Planning Mistakes to Avoid

Learning from others’ mistakes helps Missouri educators avoid costly errors affecting retirement security.

Retiring Before Thoroughly Understanding Options

The single most common mistake involves retiring without fully understanding benefit options and their long-term implications. Teachers who rush retirement decisions without careful counseling sometimes select survivor benefit options that don’t match their actual needs, retire with early retirement penalties they didn’t fully appreciate, fail to maximize their final average salary through available opportunities, or misunderstand how post-retirement employment affects benefits.

Take time for thorough planning. Schedule PSRS or PEERS counseling at least one year before retirement. Understand all options completely before making irreversible decisions.

Ignoring Healthcare Coverage Gaps

Retirees younger than Medicare eligibility age who leave teaching without securing health coverage often face catastrophic financial consequences when serious health events occur. Healthcare represents retirees’ largest controllable expense—plan for it as carefully as pension calculations.

Underestimating Longevity

Many educators retire at 60 or earlier after meeting pension eligibility requirements. If you retire at 60 and live to 90—entirely plausible with modern healthcare—your retirement lasts 30 years, potentially exceeding your working career length.

Planning for 20-30+ years of retirement changes decisions about benefit options, supplemental savings needs, and income sustainability. Don’t plan for short retirements—prepare for potentially decades of post-career life.

Failing to Coordinate Household Retirement Plans

In dual-income households, coordinating both partners’ retirement timing, healthcare coverage, and income needs requires joint planning. One spouse retiring while the other continues working creates opportunities for healthcare coverage continuation but requires careful budgeting since household income decreases while one person loses salary.

Overlooking Required Minimum Distributions

Educators with supplemental retirement accounts (403(b), IRA) must begin required minimum distributions (RMDs) at age 73 under current federal law. Failing to take RMDs results in severe tax penalties—50% of amounts that should have been withdrawn. While PSRS and PEERS pensions don’t involve RMDs (they’re paid monthly automatically), supplemental accounts require attention to distribution requirements.

Planning Throughout Your Career

Retirement planning shouldn’t wait until your final years—strategic decisions throughout teaching careers compound into significantly better retirement outcomes.

Early Career (Years 1-10)

Early-career educators should focus on understanding your retirement system and vesting timeline, contributing to supplemental retirement accounts if financially possible, building emergency funds covering 3-6 months of expenses, eliminating high-interest debt that drains resources, and establishing positive financial habits supporting long-term security.

Even modest supplemental savings during early years—$50-100 monthly—accumulate dramatically through compound growth over 30-40 year careers.

Mid-Career (Years 10-20)

Mid-career represents prime earning and saving years when many teachers have eliminated student loans and established career stability. Priorities should include increasing supplemental retirement contributions as salary grows, pursuing National Board Certification and advanced degrees increasing both current salary and eventual pension benefits, carefully tracking service credit ensuring PSRS records match actual employment, and conducting preliminary retirement projections understanding trajectory toward various retirement scenarios.

Late Career (Years 20-30+)

As retirement approaches, planning becomes increasingly specific and consequential:

5-10 Years Before Retirement: Begin focused planning including scheduling PSRS or PEERS counseling to understand options, calculating retirement income under various scenarios, assessing healthcare coverage strategies for pre-Medicare years, and considering service purchase options if military service or other eligible periods weren’t previously credited.

Final 2-3 Years: Make strategic decisions about retirement timing that maximize benefits, extra duty assignments or responsibilities increasing final average salary, survivor benefit options matching family circumstances, supplemental account distribution strategies, and coordinating with spouses about household retirement planning.

Final Year: Complete administrative requirements including formal retirement application submission (typically 60-90 days before desired retirement date), survivor beneficiary designations, tax withholding elections, and coordination with district HR regarding final paychecks and leave payouts.

The Meaning Behind the Benefits

Beyond calculations and eligibility rules, Missouri’s teacher retirement systems represent society’s commitment to honoring educators’ service. These benefits recognize that teaching isn’t merely employment but a calling requiring dedication, skill, and genuine care for students’ wellbeing and development.

The pension you’ve earned through years of 6 AM arrival times for hall duty, late evenings grading essays, weekends spent at student events, summers planning curriculum, and countless moments of individual attention to students who needed support—these benefits represent Missouri’s commitment that your service matters and your retirement security is valued.

When you reach retirement eligibility, understand that you’ve earned these benefits through decades of contributing to communities, shaping young people who became productive citizens, fostering literacy, numeracy, and critical thinking, building character and confidence in vulnerable young people, and maintaining dedication even during challenging periods when support flagged or resources proved inadequate.

Your retirement benefits represent not just financial calculations but recognition that your career mattered, your students benefited from your presence in their lives, and Missouri communities prospered because you chose teaching as your profession.

Ready to Plan Your Retirement?

If you’re a Missouri educator approaching retirement eligibility or seeking to understand your benefits comprehensively, take advantage of available resources. Visit PSRS-PEERS.org to explore benefit calculators and educational materials, schedule free personal counseling to discuss your specific situation, and consider consulting a financial planner specializing in educator retirement for comprehensive planning addressing all aspects of your financial transition.

Your teaching career represents extraordinary commitment and contribution. Approach retirement with the same thoughtfulness and planning that characterized your best teaching—and enjoy the security and freedom these benefits provide after decades of service to Missouri’s students.

Schools seeking to honor retiring educators’ lasting legacies should explore modern recognition solutions that celebrate teaching excellence as visibly and permanently as athletic achievements. When teachers see their predecessors honored meaningfully, it reinforces that their contributions will be remembered long after their final class bell rings.