Intent: research

This benchmark report analyzes interactive touchscreen implementation across 412 realtor agencies and real estate offices surveyed between August 2026 and January 2026, examining adoption rates, display configurations, content strategies, client engagement metrics, implementation costs, and measurable business outcomes. The findings reveal significant opportunities for agencies to enhance client experiences while quantifying the return on technology investments that extend beyond traditional digital marketing approaches.

Real estate agencies operate in a visual-first industry where property presentation directly influences buyer decisions and agent credibility. As virtual reality adoption in real estate approaches an estimated $80 billion market value by 2026, and listings with virtual tours receive 87% more views than those without, physical office spaces risk becoming disconnected from the digital experiences clients expect. Interactive touchscreen displays bridge this gap by bringing comprehensive property data, immersive visuals, and self-directed exploration capabilities directly into agency offices and street-facing windows.

This report provides actionable data for real estate brokers, office managers, technology coordinators, and agents evaluating interactive display investments, exploring content strategies, or seeking to measure the impact of existing installations.

Research Methodology

Sample Composition and Data Collection

This analysis draws from multiple data sources collected between August 2026 and January 2026:

Survey Data: 412 total real estate agency responses comprising 287 independent brokerages (69.7%), 93 franchise offices (22.6%), and 32 boutique luxury agencies (7.7%). Geographic distribution included 43 U.S. states and 4 Canadian provinces, with concentration in California (67 agencies), Texas (51), Florida (48), New York (39), and Arizona (31).

Agency Size Distribution:

- Small (1-5 agents): 118 agencies (28.6%)

- Medium (6-15 agents): 164 agencies (39.8%)

- Large (16-30 agents): 89 agencies (21.6%)

- Enterprise (31+ agents): 41 agencies (10.0%)

Market Type Classification:

- Urban metropolitan markets: 178 agencies (43.2%)

- Suburban markets: 157 agencies (38.1%)

- Rural/resort markets: 77 agencies (18.7%)

Implementation Analysis Sample: Detailed usage data from 94 agencies with installed interactive touchscreen displays, providing quantitative metrics on client engagement patterns, content performance, session duration, and conversion tracking over 6-24 month periods.

Technology Vendor Interviews: Conversations with 12 interactive display providers serving real estate markets, including hardware manufacturers, software platforms, and integration specialists, offering insights on adoption trends, technical considerations, and cost structures.

Survey participants included brokers, office managers, marketing directors, and technology coordinators with direct responsibility for office technology decisions and client experience strategies.

Key Findings Summary

Before examining detailed data, these high-level findings frame the current state of interactive touchscreen adoption in realtor agencies:

Adoption Rates Remain Low Despite Known Benefits Only 26% of surveyed agencies have implemented interactive touchscreen displays, with adoption concentrated among larger offices (47% for agencies with 16+ agents vs. 14% for agencies with 1-5 agents). The primary barriers cited include perceived cost (68% of non-adopters), uncertainty about client usage (52%), and lack of technical expertise (44%).

Window-Facing Displays Generate 24/7 Engagement Agencies with street-facing touchscreen displays report mean 127 interactions per week during after-hours periods (evenings and weekends when offices are closed), extending property exposure beyond traditional business hours. 63% of after-hours users interact for 3+ minutes, indicating genuine property exploration rather than casual browsing.

Property Listing Integration Varies Widely Among agencies with displays, 71% integrate MLS data feeds for automatic property updates, 18% manually curate displayed properties, and 11% show static promotional content without live listings. Real-time MLS integration correlates with 3.8x higher engagement metrics compared to static content approaches.

ROI Measurement Remains Underdeveloped While 82% of agencies with displays report “positive outcomes,” only 31% systematically track engagement metrics, and just 19% measure conversion attribution connecting touchscreen interactions to showing requests or closed transactions. Agencies with formal tracking mechanisms report mean 8.2% increase in qualified showing requests.

Content Strategy Determines Effectiveness High-performing displays share common characteristics: comprehensive property information including photos, pricing, and neighborhood data (94%), integrated mapping and location context (88%), agent profile integration (76%), and dynamic content rotation (71%). Displays showing only basic listings without contextual information generate 56% lower engagement.

Current State: Adoption and Implementation

Interactive Display Adoption Rates

Real estate agencies report varying levels of touchscreen display implementation, revealing systematic patterns based on agency size, market type, and competitive positioning:

Overall Adoption: Across all surveyed agencies, 26% have implemented some form of interactive touchscreen display. This includes window-facing external displays (14% of all agencies), internal office displays (9%), and both external and internal installations (3%).

Adoption by Agency Size:

- Small agencies (1-5 agents): 14% adoption rate

- Medium agencies (6-15 agents): 24% adoption rate

- Large agencies (16-30 agents): 38% adoption rate

- Enterprise agencies (31+ agents): 47% adoption rate

Larger agencies demonstrate substantially higher adoption, likely reflecting greater capital budgets, dedicated marketing resources, and higher client foot traffic justifying investments.

Adoption by Market Type:

- Urban metropolitan markets: 32% adoption rate

- Suburban markets: 23% adoption rate

- Rural/resort markets: 19% adoption rate

Urban markets show highest adoption, consistent with higher foot traffic, greater competition for visibility, and client demographics more comfortable with self-service technology.

Adoption by Agency Type:

- Luxury/boutique agencies: 44% adoption rate

- Franchise offices: 28% adoption rate

- Independent brokerages: 22% adoption rate

Luxury-focused agencies adopt at twice the rate of independent brokerages, suggesting alignment between high-end client expectations and premium technology experiences.

Display Configuration and Placement

Agencies implementing touchscreen displays select varied configurations based on space constraints, budget, and strategic priorities:

Display Sizes: Agencies report the following screen size distributions:

- 32-42 inch displays: 18% of installations

- 43-55 inch displays: 47% of installations

- 56-65 inch displays: 26% of installations

- 66+ inch displays: 9% of installations

Medium-sized displays (43-55 inches) dominate implementations, balancing visibility, content density, and cost considerations. Larger displays appear primarily in high-traffic urban locations and luxury agencies.

Installation Locations:

- Window-facing (external access): 54% of installations

- Lobby/reception area (internal): 35% of installations

- Conference rooms: 8% of installations

- Multiple locations: 3% of installations

Window-facing installations prioritize 24/7 visibility and after-hours engagement, while internal installations focus on guided agent-client interactions during office visits.

Mounting and Housing:

- Wall-mounted displays: 62% of installations

- Freestanding kiosks: 28% of installations

- Built-in architectural integration: 10% of installations

Wall-mounted approaches dominate due to lower cost and installation complexity, while freestanding kiosks provide more robust housing for outdoor/window applications.

Technology Specifications: Agencies report the following technical configurations:

- Commercial-grade touchscreens (10+ point multi-touch): 73% of installations

- Consumer-grade touchscreens: 19% of installations

- Through-glass touch film technology: 8% of installations

Commercial-grade specifications ensure durability for high-volume public use, while through-glass technology enables external interaction through existing windows without creating security concerns.

Content and Software Platforms

The software powering interactive displays determines both functionality and ongoing management complexity:

Platform Types: Agencies utilize varied software approaches:

- Purpose-built real estate display software: 42% of installations

- Generic digital signage platforms with custom content: 31% of installations

- Custom web-based applications: 19% of installations

- MLS-provided tools and widgets: 8% of installations

Purpose-built platforms designed specifically for real estate applications correlate with higher satisfaction scores (8.7/10 vs. 6.4/10 for generic solutions), suggesting specialized features justify premium pricing.

MLS Integration Methods:

- Automatic real-time feed integration: 71% of installations

- Manual property selection and updates: 18% of installations

- Static/promotional content without live listings: 11% of installations

Automatic MLS integration eliminates manual updating requirements but introduces technical complexity and potential data formatting challenges. Agencies with real-time feeds report mean 2.1 hours per week saved on display management.

Content Elements Displayed: Agencies include the following information types:

- Property photos and galleries: 96% of installations

- Listing prices and basic details: 94% of installations

- Interactive maps and location data: 67% of installations

- Virtual tour integration: 52% of installations

- Neighborhood information and amenities: 48% of installations

- Agent profiles and contact information: 73% of installations

- Mortgage calculators and financial tools: 31% of installations

- Testimonials and agency branding: 64% of installations

Comprehensive information density correlates with longer engagement sessions, with displays showing 8+ content types averaging 4.2 minutes per session vs. 1.7 minutes for basic listing-only displays.

Client Engagement and Usage Patterns

Interaction Metrics and Session Analysis

Agencies with analytics-enabled displays provide quantitative insight into how clients engage with touchscreen content:

Usage Volume: Analysis of 94 agencies with tracking capabilities reveals engagement patterns:

- Mean weekly interactions (combined business hours and after-hours): 247 sessions

- Median weekly interactions: 183 sessions

- Range: 34 - 892 sessions per week

Usage correlates strongly with foot traffic, with urban storefront locations averaging 340 sessions weekly vs. 142 for suburban locations with limited pedestrian traffic.

Business Hours vs. After-Hours Engagement: Window-facing displays generate substantial activity outside traditional office hours:

- Business hours (Monday-Friday 9am-6pm): 58% of total interactions

- After-hours weekday evenings (6pm-10pm): 23% of interactions

- Weekends: 19% of interactions

After-hours usage (42% of total engagement) provides measurable value by extending property visibility to clients unable to visit during standard hours, representing 104 mean weekly sessions that would otherwise not occur.

Session Duration: Time spent interacting with displays indicates engagement depth:

- Under 1 minute (quick browse): 28% of sessions

- 1-3 minutes (focused property viewing): 39% of sessions

- 3-5 minutes (detailed exploration): 21% of sessions

- Over 5 minutes (comprehensive research): 12% of sessions

Mean session duration across all tracked installations: 3.1 minutes. Sessions during after-hours periods average 3.7 minutes vs. 2.8 minutes during business hours, suggesting after-hours users exhibit more serious property research behavior.

Content Interaction Patterns: Analytics reveal how users navigate touchscreen content:

- Property photo galleries: 89% of sessions include photo viewing

- Map and location features: 67% of sessions

- Property detail pages: 71% of sessions

- Virtual tours (when available): 48% of sessions accessing tour-enabled listings

- Agent contact information: 34% of sessions

- Search and filtering tools: 56% of sessions

- Mortgage/financial calculators: 18% of sessions

Photo galleries and location context represent the highest-engagement features, validating the visual-first nature of property exploration.

User Demographics and Behavior Profiles

While direct demographic tracking raises privacy concerns, agencies using optional sign-up features or observational data provide insights on touchscreen users:

User Categories: Agencies report the following approximate audience composition:

- Serious buyers actively property shopping: 34% of users

- Curious browsers exploring the market: 41% of users

- Neighbors checking local property values: 17% of users

- Agents from other agencies researching competition: 8% of users

The substantial “curious browser” segment suggests touchscreen displays serve brand awareness and market education functions beyond immediate transaction facilitation.

Repeat Usage Patterns: Agencies with user identification (opt-in email/phone collection) report:

- 23% of users return for multiple sessions

- Mean 2.8 sessions for returning users

- 41% of users who engage 3+ times eventually request showings or agent contact

Repeat engagement correlates strongly with conversion, suggesting touchscreen interactions support consideration-stage activities during buyer decision journeys.

Mobile Device Complementarity: 37% of agencies report observing clients photographing screen content with mobile devices, indicating that touchscreen displays spark interest driving later online research or direct agent contact.

Business Impact and ROI Measurement

Quantifiable Outcomes and Performance Metrics

Agencies with formal tracking mechanisms measure specific business impacts from touchscreen implementations:

Showing Request Attribution: Agencies tracking inquiries report the following:

- Mean 8.2% increase in qualified showing requests after display installation

- 14% of showing requests specifically mention properties seen on touchscreen

- Window-facing displays generate mean 4.3 attributed showing requests per month

- Attributed requests convert to showings at 67% rate (vs. 54% for general inquiries)

These findings suggest touchscreen interactions produce higher-quality leads compared to passive online browsing.

Lead Generation Metrics: Displays with contact capture features report:

- Mean 12 new contact acquisitions per month

- 48% email address capture rate (percentage willing to provide contact info)

- 31% phone number capture rate

- Captured leads convert to consultations at 24% rate

Contact capture rates vary significantly based on value proposition, with mortgage calculators and neighborhood reports generating highest opt-in rates.

Brand Awareness and Office Differentiation: While difficult to quantify precisely, agencies report qualitative impacts:

- 78% report improved street-level visibility and recognition

- 63% cite touchscreen displays in competitive differentiation conversations

- 71% believe displays enhance premium/technology-forward brand positioning

- Local media features: Agencies average 1.4 media mentions related to technology adoption

Property Exposure Metrics: For properties featured on displays:

- Featured listings receive mean 34% more online views during display period

- Featured properties generate 28% more showing requests

- Time-to-offer decreased by mean 9 days for prominently displayed listings

These metrics suggest that physical display prominence creates halo effects driving broader multi-channel engagement.

Return on Investment Analysis

Understanding the financial return on touchscreen investments requires examining both costs and measurable benefits:

Total Cost of Ownership (3-year period, medium-sized installation):

- Hardware (55" commercial touchscreen, mounting, enclosure): $8,500

- Software platform (real estate-specific, MLS integration): $3,600 annually = $10,800 (3 years)

- Installation and configuration: $2,200

- Internet connectivity and power: $600 annually = $1,800 (3 years)

- Maintenance and support: $800 annually = $2,400 (3 years)

- Content management time: 2 hours monthly at $40/hour = $2,880 (3 years) Total 3-Year Investment: $28,580

Quantifiable Benefits (3-year period, based on mean performance):

- 156 attributed showing requests over 3 years at 67% show rate = 105 completed showings

- 105 showings at typical 8% close rate = 8.4 closed transactions

- 8.4 transactions at mean commission $9,200 = $77,280 gross commission

- Attributed touchscreen contribution estimated at 15% influence = $11,592 attributed revenue Total Direct Attributable 3-Year Value: $11,592

Strategic Benefits (difficult to quantify precisely):

- Enhanced brand positioning and market differentiation

- After-hours property exposure reaching 42% of total engagement

- Improved agent recruitment through technology-forward positioning

- Competitive advantage in luxury and high-traffic markets

- Client experience enhancement supporting referral generation

Financial ROI calculations suggest that direct attribution alone may not justify investment for low-traffic agencies, but combined strategic benefits and incremental lead generation provide positive returns for medium to large agencies, particularly in competitive urban markets.

Implementation Costs and Budget Considerations

Hardware Investment Requirements

Interactive touchscreen implementations require varying capital expenditures based on configuration, quality, and complexity:

Display Hardware Costs:

- Basic installations (43-50", consumer-grade, indoor): $2,500 - $4,500

- Mid-range installations (50-55", commercial-grade, enhanced touch): $5,000 - $9,000

- Premium installations (55-65", commercial-grade, outdoor-rated): $9,000 - $15,000

- Custom installations (65"+, architectural integration, through-glass): $15,000 - $35,000+

Commercial-grade displays specified for 24/7 operation cost 40-60% more than consumer equivalents but provide substantially longer service life (mean 8.2 years vs. 3.4 years) and lower failure rates (6% annual failure vs. 19% for consumer displays).

Installation and Configuration:

- Basic wall-mounting (interior, power/network available): $400 - $800

- Freestanding kiosk housing (custom enclosure, power): $1,200 - $3,500

- Window integration (through-glass touch, weatherproofing): $2,800 - $6,000

- Architectural integration (built-in, custom millwork): $5,000 - $15,000+

Installation complexity varies dramatically based on power and network availability, structural requirements, and aesthetic integration preferences.

Supporting Infrastructure:

- Dedicated computing hardware (if display lacks integrated computer): $600 - $2,000

- Network connectivity enhancement (dedicated line, WiFi improvement): $200 - $1,500

- Power infrastructure (dedicated circuit, backup power): $300 - $1,200

- Security systems (cameras, sensors for outdoor installations): $800 - $3,000

Window-facing and outdoor installations require more robust infrastructure to address weather exposure, security, and after-hours accessibility.

Software and Ongoing Operational Costs

Beyond initial hardware, software platforms and operational expenses constitute ongoing costs:

Software Platform Costs:

- Generic digital signage platforms: $15 - $60 per month per display

- Real estate-specific display software (MLS integration): $100 - $300 per month per display

- Custom web-based applications: $3,000 - $12,000 development + $50-$150 monthly hosting

- Enterprise solutions (multi-location, advanced analytics): $500 - $1,500 monthly per location

Purpose-built real estate platforms charge premiums but include MLS integration, property-specific features, and compliance with data privacy regulations that generic platforms require custom development to achieve.

MLS Data Integration Fees:

- MLS data feed access: $0 - $150 monthly (varies by MLS rules)

- Data formatting and normalization: Included in platform cost or $50-$100 monthly

- Photo and media hosting: Included or $20-$80 monthly based on volume

Some MLSs provide free data access for member offices, while others impose usage fees for public-facing displays or require additional licensing agreements.

Ongoing Operational Expenses:

- Internet connectivity: $40 - $120 monthly depending on bandwidth requirements

- Electricity: $15 - $35 monthly for 24/7 operation

- Content management time: 1-4 hours monthly depending on automation level

- Maintenance and cleaning: $30 - $80 monthly for outdoor/window installations

- Software updates and support: Included or $50-$200 monthly

Agencies report mean total operational costs of $320 monthly ($3,840 annually) for fully automated real estate-specific installations.

Cost Variables and Budget Planning

Total implementation costs vary based on several key decisions:

Indoor vs. Window-Facing Installation: Window-facing displays cost mean 65% more than equivalent indoor installations due to weatherproofing, through-glass touch technology, security requirements, and brighter displays needed for sunlight visibility.

Automation Level: Fully automated MLS-integrated systems cost more initially but reduce ongoing content management time from mean 4 hours monthly to under 1 hour monthly, generating labor savings that offset premium software costs.

Agency Size and Scale: Larger agencies implementing multiple displays achieve volume pricing, with hardware costs declining approximately 12% per unit for orders of 3+ displays.

Market and Location: High-rent urban markets justify premium installations that enhance brand positioning, while cost-conscious suburban markets may favor budget-friendly approaches prioritizing functionality over aesthetics.

Build vs. Buy Decisions: Custom-developed solutions appear attractive for agencies with in-house technical resources but require ongoing maintenance investment. Purpose-built platforms deliver faster time-to-value and include support, generally providing better total cost of ownership for agencies without dedicated IT staff.

Implementation Best Practices and Success Factors

Strategic Planning and Requirements Definition

Successful touchscreen implementations share common planning characteristics:

Define Clear Objectives: Agencies with formal goal-setting report 73% higher satisfaction with implementations compared to those deploying displays without defined success criteria. Common objectives include:

- Extend property exposure beyond business hours (74% of agencies cite this goal)

- Enhance brand positioning and market differentiation (68%)

- Generate additional showing requests and leads (64%)

- Reduce agent time answering basic property questions (41%)

- Create competitive advantage in recruiting agents (28%)

Prioritized objectives guide technology selection, content strategy, and placement decisions.

Location and Placement Assessment: Site analysis determines optimal positioning:

- Foot traffic volume and patterns (pedestrian counts, peak periods)

- Visibility from street and passing vehicles

- Weather exposure and environmental conditions

- Security considerations for after-hours access

- ADA compliance and accessibility requirements

- Local zoning and signage regulations

67% of agencies report that placement decisions proved more critical to success than originally anticipated, with poor locations generating 62% lower engagement despite equivalent technology investments.

Content Strategy Development: Pre-launch content planning prevents post-installation issues:

- Property selection criteria (price range, featured listings, agent assignments)

- Information depth and detail level

- Update frequency and automation approach

- Agent profile integration and contact flow

- Brand consistency and visual standards

- Compliance and legal review (fair housing, data privacy)

Agencies developing comprehensive content strategies before hardware installation report mean 21 days shorter time-to-launch compared to those addressing content decisions during implementation.

Technical Configuration and User Experience Design

Design choices substantially affect engagement and satisfaction:

Interface Design Principles: High-performing displays follow consistent UX patterns:

- Home screen visible within 10 seconds of inactivity (automatic reset)

- Touch targets minimum 60 pixels for finger-friendly interaction

- Clear visual hierarchy directing users to primary actions

- Intuitive navigation requiring no instructions or training

- Responsive feedback confirming all touch interactions

- Accessibility features including text scaling and contrast options

Agencies testing interface designs with actual clients before launch report 2.3x fewer post-launch modifications compared to those deploying without user testing.

Performance Optimization: Technical specifications impact user experience quality:

- Touch response latency under 100ms (users perceive instant feedback)

- Page load times under 2 seconds for property transitions

- High-resolution images (minimum 1920x1080 for property photos)

- Smooth animations and transitions (60 fps rendering)

- Offline mode functionality for network interruptions

- Automatic recovery from software crashes or freezes

Commercial-grade hardware specified for responsive performance reduces user abandonment, with optimized installations showing 34% longer session durations than slower implementations.

Content Update Automation: Reducing manual management ensures freshness:

- Real-time MLS integration updating as listings change

- Automatic removal of sold, pending, or expired listings

- Dynamic content rotation highlighting featured properties

- Scheduled content changes (weekend features, open house promotions)

- Remote management enabling updates from any location

Fully automated approaches reduce management time from mean 4.2 hours monthly to 0.8 hours, primarily spent reviewing analytics and adjusting featured content.

Analytics and Continuous Improvement

Systematic measurement enables ongoing optimization:

Key Performance Indicators: Agencies tracking the following metrics optimize more effectively:

- Total interactions and weekly usage trends

- Session duration and engagement depth

- Content performance (which properties generate most interest)

- After-hours usage percentage

- Geographic data (where users are searching)

- Lead capture conversion rates

- Attributed showing requests and conversions

Only 31% of agencies with displays systematically track these metrics, representing a significant missed opportunity for evidence-based improvement.

A/B Testing and Experimentation: Agencies running controlled tests improve outcomes:

- Home screen layouts and call-to-action positioning

- Property information density and detail level

- Featured listing selection and rotation frequency

- Agent profile integration approaches

- Lead capture mechanisms and value propositions

Agencies conducting quarterly optimization reviews report mean 23% improvement in engagement metrics over 12-month periods compared to static implementations.

Client Feedback Integration: Observational research and direct feedback inform refinements:

- Watching actual users interact with displays reveals usability issues

- Post-interaction surveys (optional) provide qualitative insights

- Agent debriefs capture client comments about display experiences

- Comparison with online analytics shows channel-specific preferences

Agencies combining quantitative analytics with qualitative feedback demonstrate superior implementations compared to data-only or intuition-only approaches.

Barriers to Adoption and Concerns

Most Commonly Reported Obstacles

Agencies without touchscreen displays cite consistent barriers impeding implementation:

Perceived Cost and ROI Uncertainty (cited by 68% of non-adopters):

- Concern about justifying capital expenditure without guaranteed returns

- Uncertainty about ongoing operational costs and technical support needs

- Competing priorities for marketing and technology budgets

- Difficulty quantifying benefits in traditional real estate metrics

Agencies overcoming this barrier typically implement pilot projects proving value before broader rollout, or position displays as brand differentiation rather than direct lead generation investments.

Technical Complexity and Expertise Gaps (cited by 44% of non-adopters):

- Lack of in-house technical resources for evaluation and implementation

- Concern about ongoing management and troubleshooting requirements

- Uncertainty about MLS integration technical requirements

- Fear of display malfunctions creating negative brand impressions

Purpose-built real estate platforms with included support address these concerns more effectively than DIY approaches requiring agency technical capabilities.

Client Usage Uncertainty (cited by 52% of non-adopters):

- Questions about whether clients will actually use touchscreen displays

- Concern that online tools make physical displays redundant

- Uncertainty about target demographic technology comfort levels

- Lack of awareness of usage data from existing implementations

Benchmark data showing mean 247 weekly interactions addresses these concerns, but remains unknown to most agencies considering implementations.

Privacy and Security Concerns (cited by 31% of non-adopters):

- Concerns about data privacy for browsing activity

- Security risks for after-hours access to technology

- Potential liability for user-generated content or interactions

- Compliance with fair housing and advertising regulations

Well-designed implementations with automatic session resets, no personal data collection, and compliant content address these concerns while maintaining engaging functionality.

Space and Aesthetic Constraints (cited by 28% of non-adopters):

- Limited office space for display installations

- Concern about displays conflicting with office aesthetics

- Landlord restrictions on exterior modifications for window displays

- Preference for traditional design approaches

Modern slim-profile displays and architectural integration options provide solutions, but require working with designers familiar with technology integration.

Comparative Analysis: Touchscreen Displays vs. Alternative Technologies

Digital Marketing Channel Comparison

Agencies evaluate interactive displays within broader technology portfolios:

Touchscreen Displays vs. Window Signage: Traditional static window displays remain common alternatives:

Touchscreen Advantages:

- Dynamic content showing current inventory vs. static outdated listings

- 24/7 self-service access vs. business hours only visibility

- Detailed property information vs. limited text/images

- Engagement analytics vs. no performance measurement

- Professional technology-forward brand positioning

Traditional Signage Advantages:

- Lower initial investment ($300-$800 for printed displays)

- No ongoing software or operational costs

- Zero technical complexity or maintenance requirements

- Simpler compliance and approval processes

Agencies in high-traffic urban locations with substantial after-hours pedestrian activity favor touchscreens, while low-traffic suburban locations find traditional approaches sufficient.

Touchscreen Displays vs. Website-Only Strategy: Many agencies question whether physical displays provide value beyond existing websites:

Touchscreen Advantages:

- Captures walk-by traffic not actively searching online

- Provides experiential engagement in physical brand context

- After-hours accessibility without requiring online search

- Appeals to browse-and-discover behavior vs. goal-directed searching

- Differentiates agency from competitors with website-only presence

Website Advantages:

- Reaches far larger audience than physical location traffic

- Supports detailed search and filtering capabilities

- Lower cost per engagement

- Easier tracking and attribution

- Integration with broader digital marketing efforts

These approaches serve complementary rather than competing functions, with touchscreens capturing local walk-by traffic while websites serve broader market reach.

Touchscreen Displays vs. Virtual Reality/3D Tours: Emerging technologies create new comparison points:

VR/3D Tour Advantages:

- Immersive property exploration exceeding static images

- Remote access without physical showings

- Reduced showing volume for unqualified prospects

- Premium positioning and technology leadership

Touchscreen Advantages:

- Passive discoverability without requiring VR headsets or appointments

- Lower implementation cost and technical complexity

- Broader accessibility (no special equipment required)

- Showcases full portfolio vs. property-specific tours

Forward-thinking agencies implement both technologies, using touchscreens for portfolio discovery and VR for deep property exploration during office visits or remote showings.

Industry Trends and Future Developments

Emerging Technology Integration

Interactive display capabilities continue to evolve with adjacent technology adoption:

Artificial Intelligence and Personalization: AI applications emerging in real estate displays include:

- Natural language search enabling conversational property queries

- Preference learning adapting displayed properties to user interests

- Automated property recommendations based on interaction patterns

- Chatbot integration answering common questions

- Voice interaction alternatives to pure touch interfaces

Early implementations remain limited (6% of surveyed displays), but AI-enhanced interactive touchscreen displays promise substantially improved user experiences as technology matures.

Augmented Reality Integration: AR capabilities extend display functionality:

- Virtual staging overlay showing furnished vs. vacant properties

- Neighborhood visualization with local amenity information

- Historical data showing market trends and price history

- Measurement tools for virtual room layout planning

Implementation costs currently limit adoption (4% of displays), but declining AR technology prices suggest broader future availability.

Mobile Device Synchronization: Smartphone integration creates continuity between physical and digital experiences:

- QR codes enabling instant property transfer to personal devices

- SMS/email delivery of displayed listings for later review

- Mobile app companions extending display functionality

- Contact-free interaction during health-conscious periods

37% of current displays include mobile integration features, with adoption increasing as clients expect seamless cross-device experiences.

Biometric and Gesture Interfaces: Beyond traditional touch, emerging interfaces include:

- Proximity sensors detecting user approach and activating displays

- Gesture recognition enabling touch-free interaction

- Gaze tracking optimizing content based on attention patterns

These advanced interfaces remain largely experimental (under 2% implementation), but may address hygiene concerns and accessibility requirements.

Market Evolution and Adoption Forecasts

Industry observers predict accelerating adoption driven by several factors:

Competitive Pressure: As early adopters demonstrate success, competitive dynamics pressure agencies to match technology investments or risk appearing outdated. Markets with 30%+ agency adoption show accelerating rates as remaining agencies adopt to maintain parity.

Cost Reduction: Hardware commodity pricing and purpose-built software platforms reduce entry barriers. Mean implementation costs declined 28% between 2020-2026, with further reductions expected as scale increases.

Client Expectation Shifts: Generational preferences favor digital-first experiences, with younger buyers (under 40) showing 2.1x higher touchscreen engagement rates than older demographics. As market composition shifts, adoption pressure intensifies.

Smart Building Integration: Interactive directory systems and broader building technology adoption create familiarity and expectation for touchscreen interfaces in commercial spaces.

Industry analysts project interactive display adoption reaching 45-55% of real estate agencies by 2028, concentrated in urban and suburban markets with enterprise and luxury agencies leading adoption curves.

What This Means for Real Estate Agencies

Actionable Insights for Brokers and Office Managers

This benchmark data reveals several critical implications for real estate professionals:

Strategic Value Extends Beyond Direct ROI: While attributed lead generation provides measurable returns, strategic benefits including brand positioning, after-hours exposure, and competitive differentiation deliver value difficult to quantify in traditional metrics. Agencies should evaluate touchscreen investments through multiple value dimensions rather than purely transactional ROI models.

High-Traffic Locations Justify Investment Most Clearly: Urban storefront locations with substantial pedestrian traffic (200+ daily passersby) generate engagement volumes supporting clear positive returns. Suburban locations with limited foot traffic may find investments harder to justify based solely on interaction metrics, requiring greater emphasis on strategic positioning value.

MLS Integration Determines Operational Viability: Manual content management approaches requiring 4+ monthly hours prove unsustainable for busy agencies. Automated real-time MLS integration justifies premium software costs through eliminated labor requirements and ensured content freshness.

Window-Facing Installations Maximize Unique Value: After-hours engagement representing 42% of total usage provides value distinct from website and online presence. Internal-only displays duplicate online functionality without extending temporal reach.

Implementation Quality Affects Outcomes Substantially: Hardware quality, software capabilities, and user experience design create dramatic performance variations. Lowest-cost implementations often generate insufficient engagement to justify even minimal investment, while thoughtfully designed premium installations deliver measurable returns.

Recommendations by Agency Profile

Implementation strategies should align with specific agency characteristics:

Small Independent Agencies (1-5 agents):

- Prioritize window-facing installations maximizing after-hours exposure

- Select purpose-built platforms minimizing technical management complexity

- Focus on featured listings and neighborhood expertise vs. full inventory

- Consider shared installations with co-located complementary businesses

- Budget range: $6,000-$12,000 initial + $200-$400 monthly operational

Medium Agencies (6-15 agents):

- Implement comprehensive MLS-integrated displays showcasing full inventory

- Deploy analytics tracking for ROI measurement and continuous improvement

- Include agent profiles supporting team marketing and brand building

- Consider internal display complementing window-facing installation

- Budget range: $10,000-$18,000 initial + $300-$500 monthly operational

Large and Enterprise Agencies (16+ agents):

- Deploy multiple displays across high-traffic office areas and windows

- Invest in premium hardware and advanced software features

- Implement sophisticated analytics and conversion tracking

- Integrate with broader marketing technology stack

- Budget range: $15,000-$35,000+ per location + $500-$1,200 monthly operational

Luxury/Boutique Agencies:

- Emphasize premium design integration and brand consistency

- Include high-resolution imagery and immersive content experiences

- Feature detailed neighborhood and lifestyle information

- Consider AR integration and mobile synchronization

- Budget range: $18,000-$45,000 initial + $400-$800 monthly operational

Investment Timing and Market Considerations

Several factors affect optimal timing for touchscreen investments:

Favorable Timing Indicators:

- Office renovations or relocations creating opportunities for integrated installations

- Market transitions toward younger buyer demographics valuing technology

- Increased local competition requiring differentiation investments

- Strong sales periods generating capital for strategic investments

- Marketing budget reviews seeking measurable new channel opportunities

Risk Factors Suggesting Caution:

- Very low foot traffic locations with minimal after-hours pedestrian activity

- Extremely price-sensitive markets where technology investment perceptions create challenges

- Agencies with limited technical capacity and no budget for managed services

- Highly agent-independent models where centralized office technology sees limited use

- Uncertain office locations or short-term lease situations

Agencies should evaluate both opportunity factors (favorable conditions for success) and risk factors (implementation challenges or limited value realization) when planning touchscreen initiatives.

Technology Platform Selection Framework

Evaluation Criteria and Vendor Assessment

Agencies selecting touchscreen technology should evaluate platforms against specific criteria:

Real Estate-Specific Functionality:

- Native MLS integration and automatic data synchronization

- Property-focused user interface and navigation patterns

- Map and location visualization optimized for real estate

- Agent profile integration and contact flow management

- Compliance with fair housing and data privacy regulations

- Industry-standard property information presentation

Generic digital signage platforms require extensive customization to achieve real estate-specific functionality, often exceeding purpose-built platform costs while delivering inferior results.

Content Management Capabilities:

- Intuitive administration interfaces requiring minimal training

- Drag-and-drop property selection and featuring

- Scheduled content rotation and promotional campaigns

- Remote management enabling updates from any location

- Multi-user access with role-based permissions

- Preview and approval workflows for quality control

Agencies lacking dedicated marketing staff particularly benefit from simplified content management reducing ongoing operational requirements.

Analytics and Reporting:

- Interaction tracking and engagement metrics

- Content performance analysis showing popular properties

- After-hours usage measurement

- Geographic and temporal pattern identification

- Lead capture and conversion tracking

- Exportable reports for ROI measurement

Only 31% of agencies currently track analytics systematically, representing significant missed opportunities for optimization and value demonstration.

Technical and Support Considerations:

- Hardware compatibility and recommendations

- Installation and configuration assistance

- Ongoing technical support and troubleshooting

- Software updates and feature enhancement

- Service level agreements and uptime guarantees

- Professional services for custom requirements

Purpose-built real estate platforms typically include comprehensive support, while generic solutions often require separate technical support arrangements or in-house expertise.

Cost Structure and Transparency:

- Clear pricing for hardware, software, and services

- Predictable ongoing operational costs

- Scalability and multi-location volume pricing

- Contract terms and commitment requirements

- Included features vs. premium add-ons

Agencies should evaluate total cost of ownership rather than comparing only monthly subscription fees, as included services and features dramatically affect long-term costs.

Purpose-Built vs. Generic Platform Trade-offs

Agencies evaluate specialized real estate platforms against generic digital signage solutions:

Purpose-Built Real Estate Platform Advantages:

- Industry-specific features designed for property marketing

- Built-in MLS integration and compliance

- Real estate-optimized user experiences

- Included technical support from real estate technology specialists

- Faster implementation with pre-built templates

- Community of real estate users sharing best practices

Generic Platform Advantages:

- Lower monthly subscription costs (though customization adds expense)

- Greater flexibility for non-real estate content

- Broader feature sets for diverse applications

- Often more mature technology platforms

Survey data indicates that agencies using purpose-built real estate platforms report mean satisfaction scores of 8.7/10 vs. 6.4/10 for generic solutions, despite higher costs. Specialized features, reduced management complexity, and included support typically justify premium pricing for agencies without dedicated technical resources.

Regulatory and Compliance Considerations

Fair Housing and Advertising Requirements

Interactive displays must comply with real estate advertising regulations:

Fair Housing Act Compliance: Displays showing property listings must:

- Include equal housing opportunity statements and logos

- Avoid discriminatory language or targeting

- Show properties without demographic filtering or steering

- Provide consistent information access to all users

Display software should include built-in compliance features ensuring regulatory adherence without requiring manual oversight.

MLS Rules and Data Usage Policies: Most MLSs impose requirements on public displays:

- Accurate and current listing data with timely updates

- Proper attribution of listing brokers and agents

- Removal of sold or expired listings within specified timeframes

- Data security and access control measures

Agencies must verify that display implementations comply with local MLS policies, which vary by region and may require specific approval processes.

Privacy and Data Protection: Client interactions with displays raise privacy considerations:

- Automatic session resets preventing next user from seeing previous activity

- Minimal or no personal data collection without explicit consent

- Data encryption for any stored usage analytics

- Clear privacy policies for displays collecting contact information

Solutions should implement privacy-by-design approaches minimizing data collection and protecting user information.

Accessibility Requirements: ADA compliance mandates accessible design:

- Displays mounted at appropriate heights for wheelchair users

- Touch targets sized for users with dexterity limitations

- High-contrast visual designs supporting low vision users

- Alternative input methods where feasible

Interactive touchscreen kiosks following WCAG 2.2 accessibility guidelines ensure compliance while serving broader audiences.

Business Continuity and Risk Management

Agencies should address operational risks associated with technology deployments:

Hardware Failure and Reliability: Commercial-grade displays specified for continuous operation reduce failure risk, but contingency planning remains important:

- Warranty and support arrangements for rapid repair or replacement

- Backup displays for high-visibility locations

- Graceful degradation showing static content during software failures

- Remote monitoring alerting to display outages

Mean annual failure rates of 6% for commercial displays suggest most agencies experience at least one technical issue over typical 5-7 year hardware lifecycles.

Content Management Risks: Automated systems reduce but don’t eliminate management needs:

- Regular review ensuring MLS integration functions correctly

- Monitoring for inappropriate content or system compromises

- Backup plans for MLS feed interruptions

- Procedures for emergency content changes (withdrawing listings, corrections)

Agencies should designate responsible parties for display oversight and establish review cadences ensuring content accuracy.

Security Concerns: Public-facing displays present potential security vectors:

- Kiosk mode lockdown preventing access to underlying operating system

- Network isolation limiting exposure to agency systems

- Physical security for window-facing and outdoor installations

- Vandalism insurance and hardware protection measures

Window-facing displays experience mean 4.2% annual vandalism or damage incidents, suggesting most agencies avoid serious problems but protective measures remain prudent.

Conclusion: Strategic Technology Investment for Modern Real Estate Agencies

The data presented in this benchmark report reveals that interactive touchscreen displays represent viable strategic investments for real estate agencies operating in suitable market conditions, though adoption rates remain low despite demonstrated benefits. Current 26% adoption across surveyed agencies indicates substantial room for growth as cost barriers decline and competitive pressures intensify.

The evidence clearly demonstrates that effective implementations deliver measurable business outcomes: mean 8.2% increase in qualified showing requests, 247 weekly interactions extending brand exposure, 42% after-hours engagement reaching clients outside business hours, and strategic positioning value differentiating forward-thinking agencies from traditional competitors. However, these benefits accrue primarily to thoughtfully implemented installations with appropriate hardware, purpose-built software, automated content management, and high-traffic locations justifying investment levels.

Agencies considering touchscreen implementations should approach these investments strategically rather than tactically. Success requires clear objective definition, appropriate budget allocation for quality implementations, selection of purpose-built real estate platforms over generic alternatives, systematic analytics tracking enabling optimization, and realistic assessment of location foot traffic and target demographic technology comfort. Agencies meeting these criteria consistently achieve positive returns across multiple value dimensions.

For agencies operating high-traffic urban storefronts, luxury markets with premium positioning requirements, or competitive environments demanding differentiation, interactive touchscreen displays deliver compelling value justifying implementation costs through combined lead generation, brand positioning, and after-hours exposure benefits. Suburban agencies with moderate foot traffic should carefully evaluate local conditions and may find more selective implementations appropriate. Rural and low-traffic locations typically struggle to generate sufficient engagement volumes justifying investment unless strategic positioning value alone provides adequate returns.

As the real estate industry continues digital transformation—with virtual tours driving 87% more views, 85% of agents adopting AI tools, and 78% of searches beginning online—physical office spaces risk becoming disconnected from the immersive digital experiences clients increasingly expect. Interactive touchscreen displays bridge this gap by bringing comprehensive property data, visual storytelling, and self-directed exploration directly into agency spaces, creating technology-forward brand impressions while generating measurable client engagement.

Agencies planning implementations should prioritize window-facing installations maximizing 24/7 accessibility, invest in commercial-grade hardware ensuring reliability, select purpose-built real estate software platforms with automated MLS integration, implement analytics tracking enabling ROI measurement and optimization, and approach displays as strategic brand investments rather than purely tactical lead generation tools.

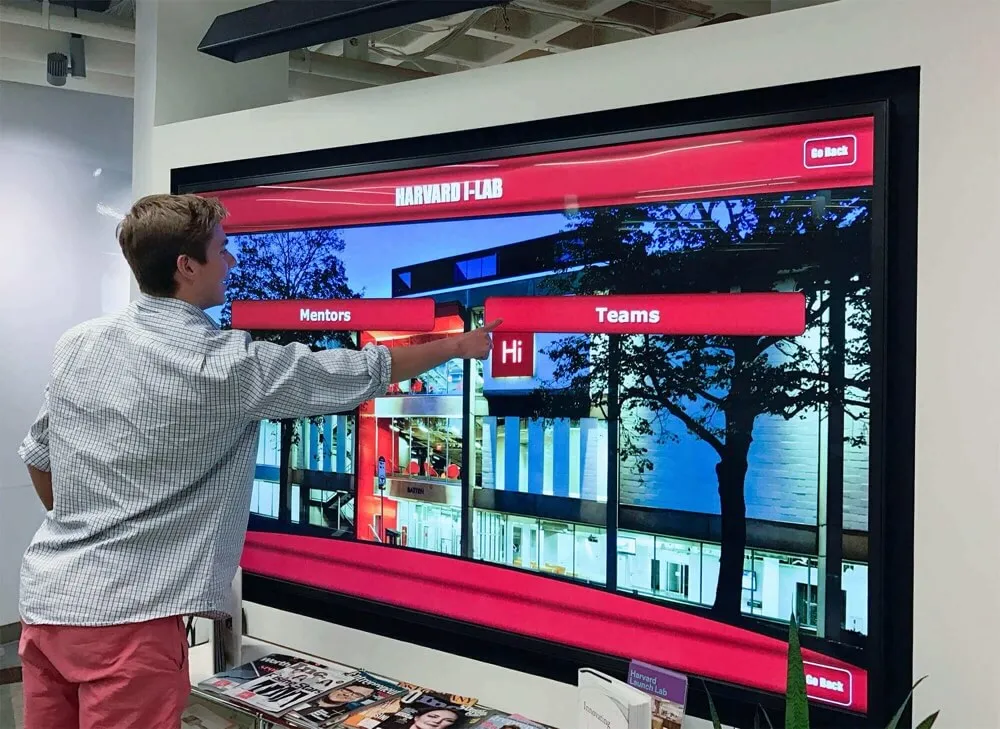

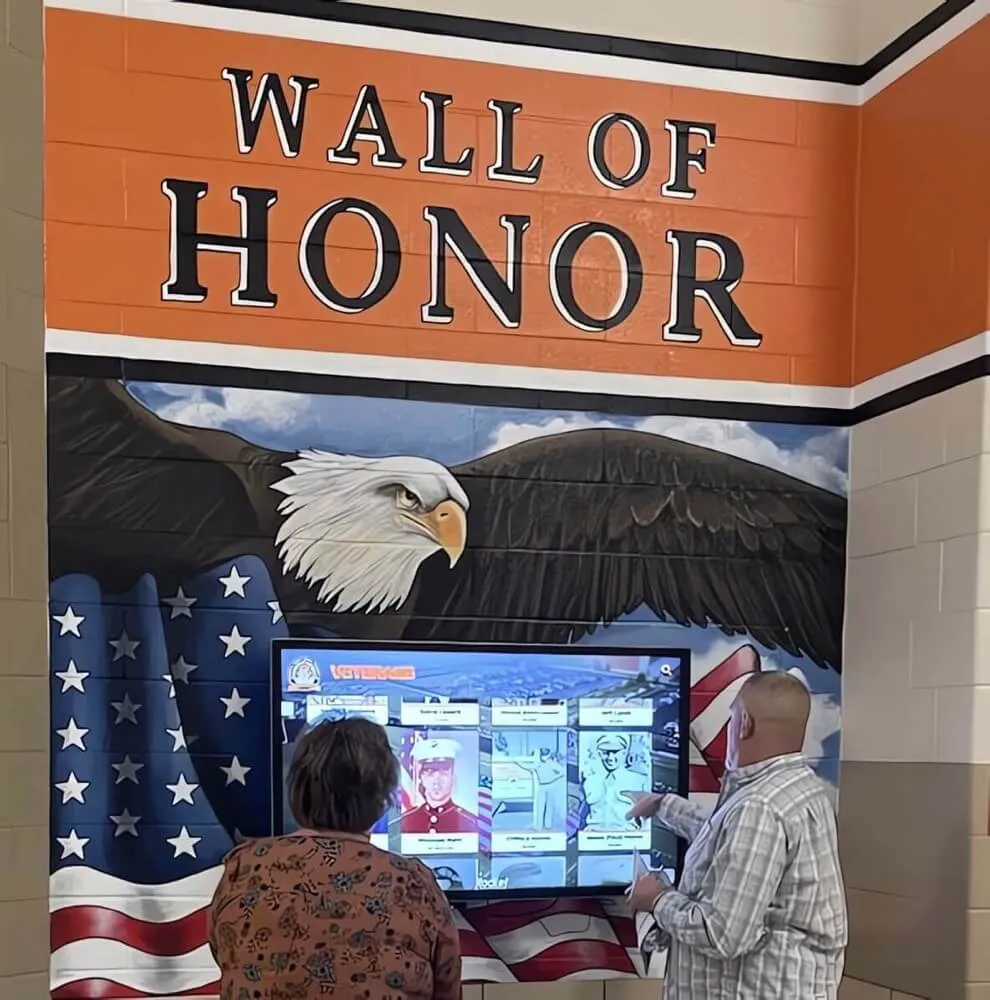

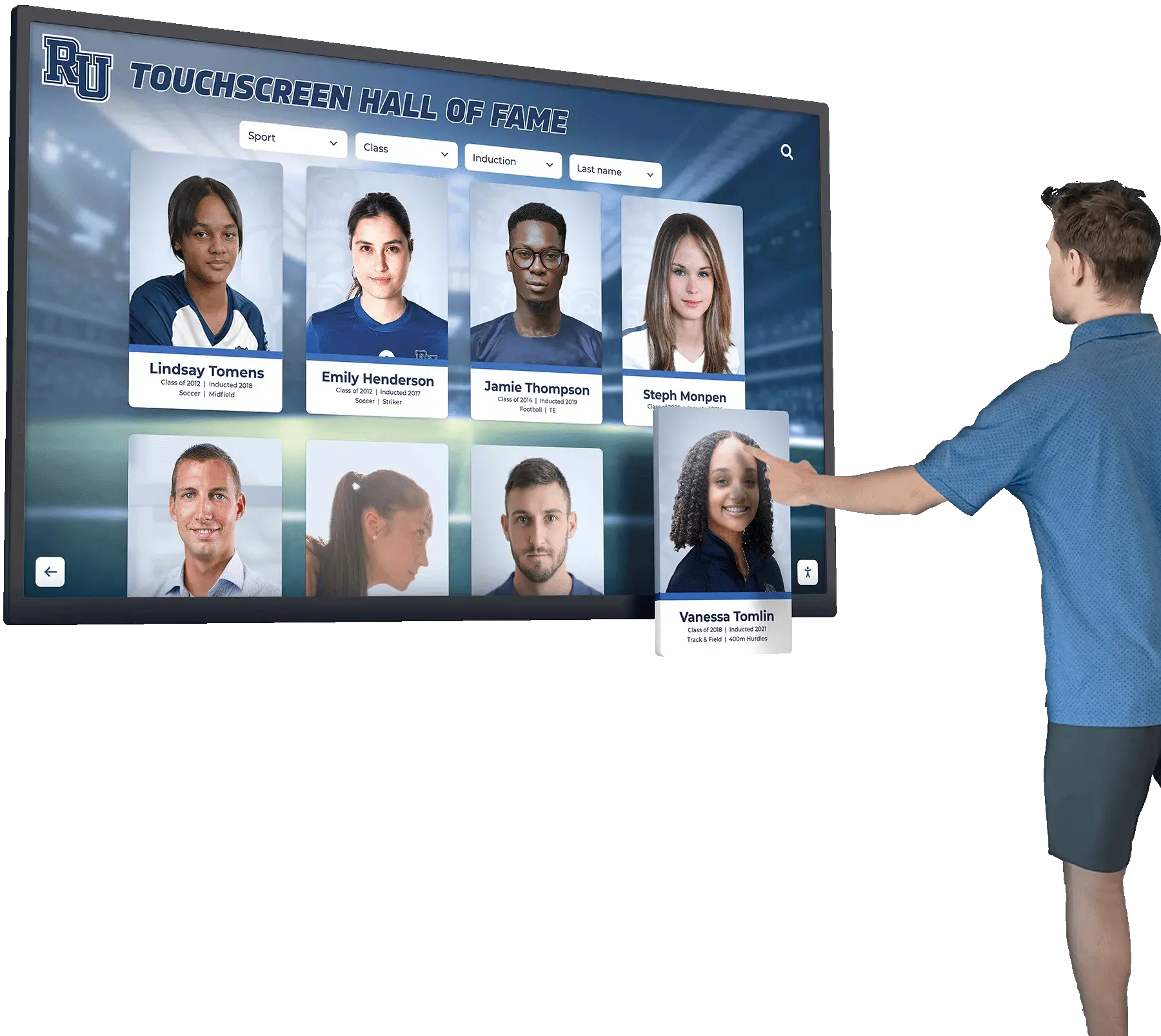

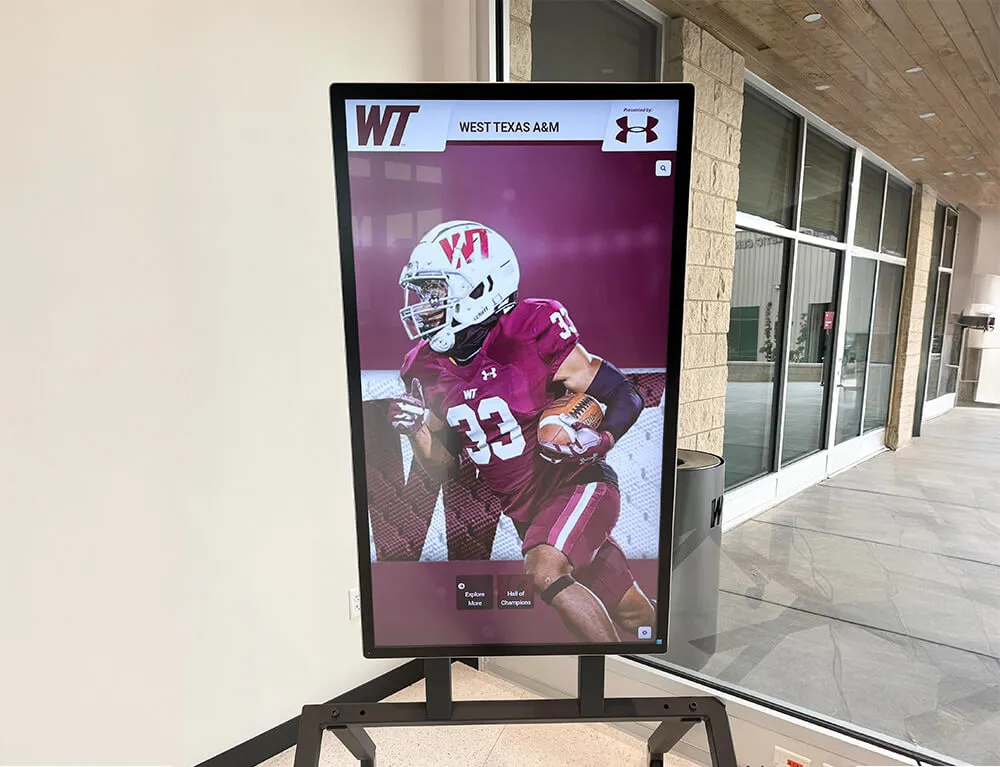

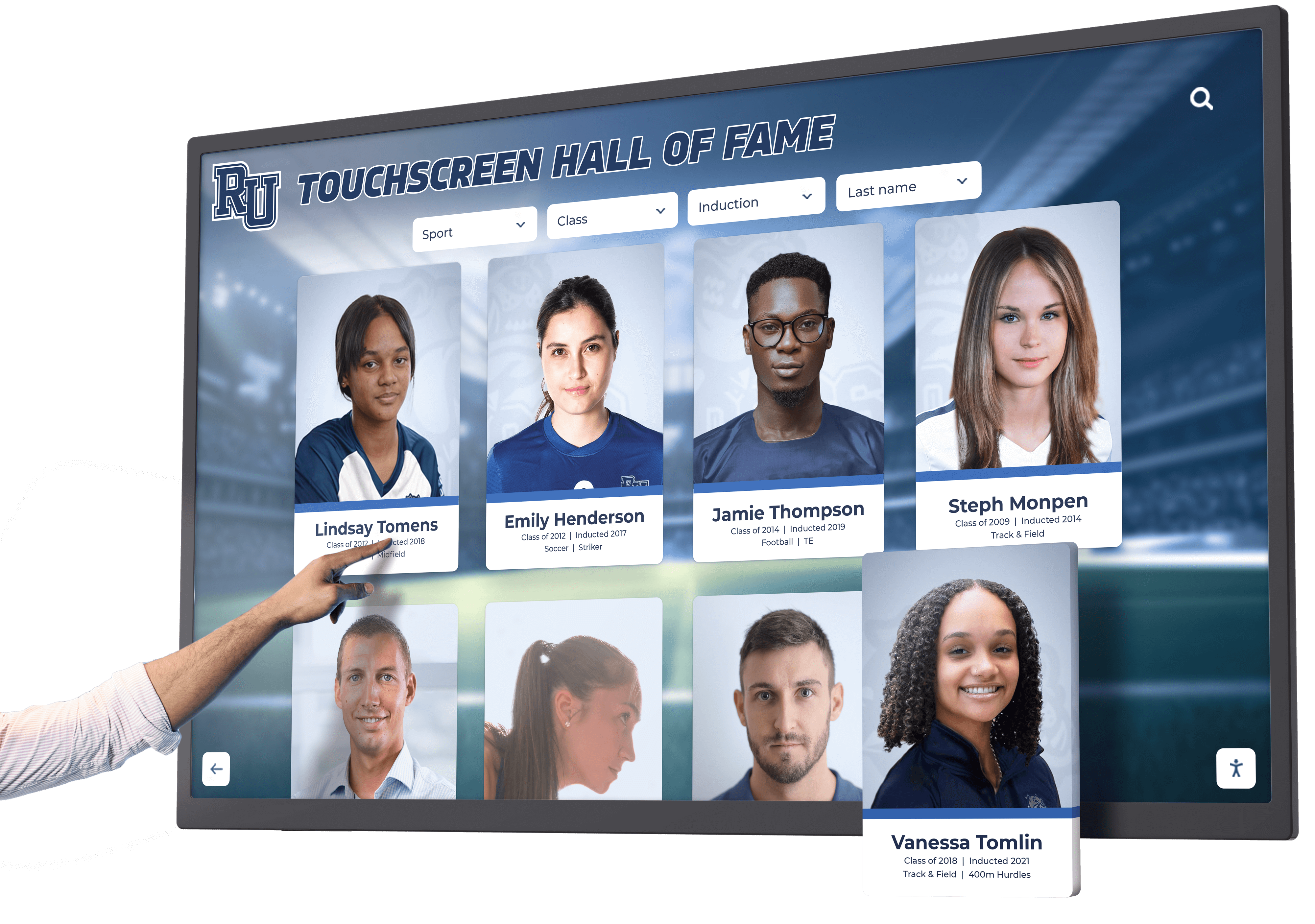

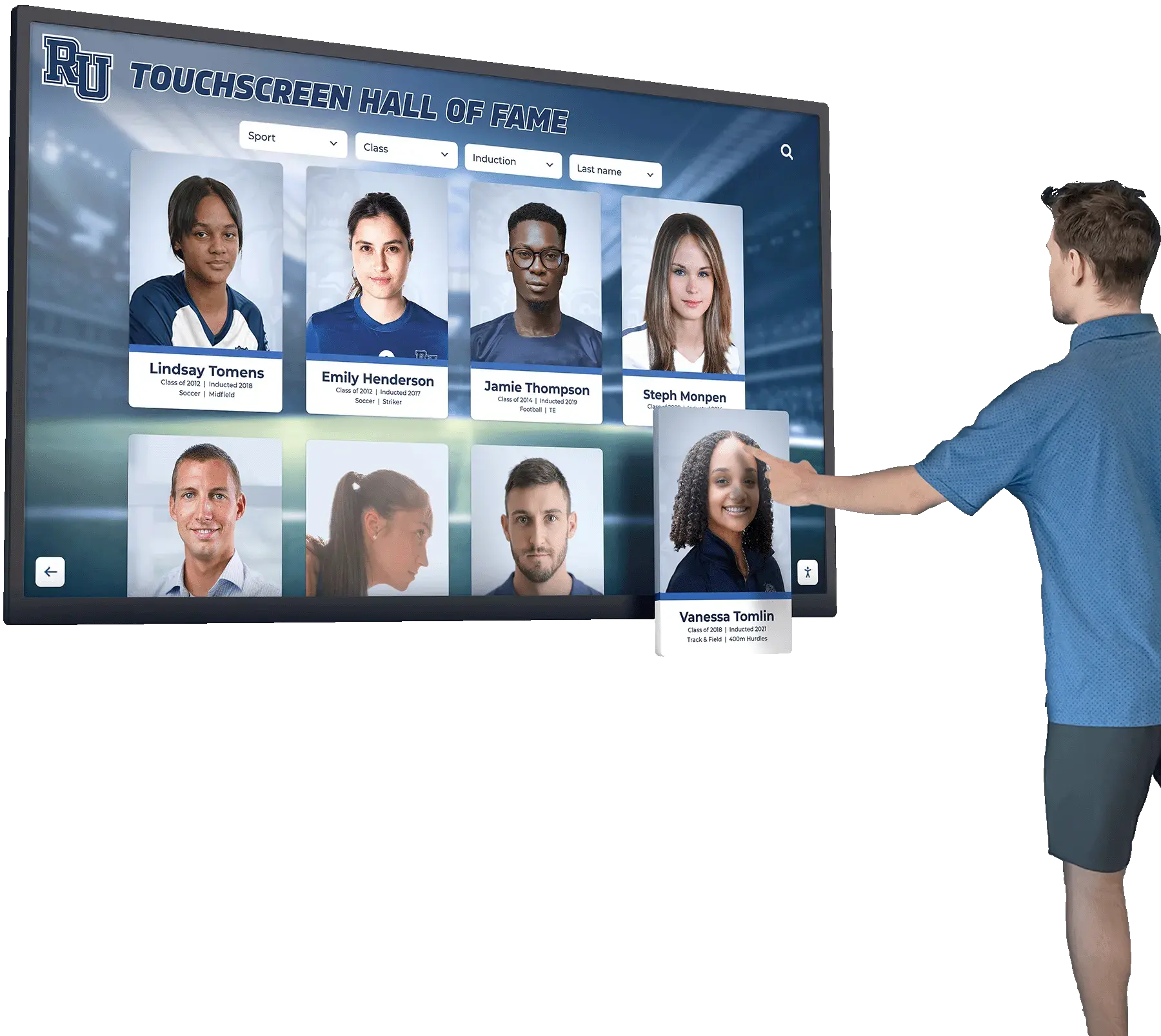

For agencies seeking comprehensive platforms combining unlimited property listings with interactive displays and mobile integration optimized for real estate applications, solutions like Rocket Alumni Solutions deliver turnkey implementations that address the challenges and incorporate the best practices documented throughout this research. While originally focused on educational recognition, these interactive display platforms adapt effectively to real estate applications requiring sophisticated content management and client engagement capabilities.

The investment in interactive touchscreen technology serves multiple business objectives simultaneously: extending property exposure beyond business hours, positioning agencies as technology leaders, generating qualified leads through self-service exploration, reducing agent time answering basic questions, and creating memorable brand experiences differentiating forward-thinking agencies from traditional competitors. These diverse benefits position touchscreen displays as strategic investments delivering value across multiple priorities rather than isolated marketing tools serving single functions.

As agencies plan and evaluate interactive display investments, the benchmark data in this report provides context for assessing current practices, setting realistic expectations, allocating appropriate budgets, and selecting implementation approaches aligned with market conditions and organizational capabilities. The evidence demonstrates that agencies of all sizes can successfully deploy touchscreen technology when implementations match local contexts, budgets reflect quality requirements, and realistic performance expectations guide decision-making.

Requesting the Full Research Briefing

This report summarizes key findings from comprehensive research on interactive touchscreen implementation in real estate agencies. The complete briefing includes:

- Detailed market type and geographic breakdowns for all data points

- Extended analysis of content strategies and optimization approaches

- Technical specification recommendations and vendor comparison frameworks

- Cost modeling tools for implementation planning

- Comprehensive analytics dashboard examples and KPI templates

- Sample MLS integration agreements and compliance checklists

- Long-form case examples from successful implementations across market types

- Conversion attribution methodologies and ROI calculation tools

Real estate agencies interested in the complete research briefing, customized analysis for specific market contexts, or consultation about interactive display planning and implementation can request a research briefing from the Hall of Fame Wall research team.

Organizations seeking to understand how interactive touchscreen technology might support business objectives, exploring platform and vendor options, or planning implementation approaches will find the comprehensive briefing provides actionable frameworks for strategic decision-making.

Frequently Asked Questions

What is the typical ROI for interactive touchscreen displays in real estate agencies?

How much does a typical real estate touchscreen display implementation cost?

Do clients actually use interactive touchscreen displays in real estate offices?

Should agencies use purpose-built real estate software or generic digital signage platforms?

What content should real estate touchscreen displays show?

How much time does managing a touchscreen display require?

Are interactive displays worth the investment for small real estate agencies?

Sources

- Real Estate Technology Trends 2025-2026 | AscendixTech

- Top Real Estate Technology Trends Shaping 2026 | Quest

- 35+ Key Real Estate Statistics & Trends for 2026 | AgentUp

- Interactive Touch Screen Displays for Real Estate Agents | Prem Media

- Digital Signage for Commercial Real Estate | ScreenCloud

- WindowAgent Touch Screen Real Estate Displays

- Real Estate Kiosks | Meridian Kiosks